estimateFrontierByRisk

Estimate optimal portfolios with targeted portfolio risks

Syntax

Description

[

estimates optimal portfolios with targeted portfolio risks for

pwgt,pbuy,psell]

= estimateFrontierByRisk(obj,TargetRisk)Portfolio, PortfolioCVaR, or

PortfolioMAD objects. For details on the respective

workflows when using these different objects, see Portfolio Object Workflow, PortfolioCVaR Object Workflow,

and PortfolioMAD Object Workflow.

[

adds name-optional name-value pair arguments for pwgt,pbuy,psell]

= estimateFrontierByRisk(___,Name,Value)Portfolio or

PortfolioMAD objects.

Examples

To obtain efficient portfolios that have targeted portfolio risks, the estimateFrontierByRisk function accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks. Assume you have a universe of four assets where you want to obtain efficient portfolios with target portfolio risks of 12%, 14%, and 16%. This example uses the default 'direct' method to estimate the optimal portfolios with targeted portfolio risks.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

p = Portfolio;

p = setAssetMoments(p, m, C);

p = setDefaultConstraints(p);

pwgt = estimateFrontierByRisk(p, [0.12, 0.14, 0.16]);

display(pwgt);pwgt = 4×3

0.3984 0.2659 0.1416

0.3064 0.3791 0.4474

0.0882 0.1010 0.1131

0.2071 0.2540 0.2979

To obtain efficient portfolios for a Portfolio object that has targeted portfolio risks, estimateFrontierByRisk accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks.

Load the stock price data and set portfolio constraints so that the total weight of the portfolio must equal 1 and the maximum allocation to for any one stock is 50%, while the minimum is 5%.

T = readtable('dowPortfolio.xlsx');

| Dates | DJI | AA | AIG | AXP | BA | C | CAT | DD | DIS | GE | GM | HD | HON | HPQ | IBM | INTC | JNJ | JPM | KO | MCD | MMM | MO | MRK | MSFT | PFE | PG | T | UTX | VZ | WMT | XOM |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

1 | 1/3/2006 | 1.0847e+04 | 28.7200 | 68.4100 | 51.5300 | 68.6300 | 45.2600 | 55.8600 | 40.6800 | 24.1800 | 33.6000 | 17.8200 | 39.7900 | 36.1400 | 28.3500 | 80.1300 | 24.5700 | 59.0800 | 37.7800 | 38.9800 | 32.7200 | 75.9300 | 52.2700 | 30.7300 | 26.1900 | 22.1600 | 56.3800 | 22.7000 | 54.9400 | 26.7900 | 44.9000 | 56.6400 |

2 | 1/4/2006 | 1.0880e+04 | 28.8900 | 68.5100 | 51.0300 | 69.3400 | 44.4200 | 57.2900 | 40.4600 | 23.7700 | 33.5600 | 18.3000 | 39.0500 | 35.9900 | 29.1800 | 80.0300 | 24.9000 | 59.9900 | 37.5600 | 38.9100 | 33.0100 | 75.5400 | 52.6500 | 31.0800 | 26.3200 | 22.8800 | 56.4800 | 22.8700 | 54.6100 | 27.5800 | 44.9900 | 56.7400 |

3 | 1/5/2006 | 1.0882e+04 | 29.1200 | 68.6000 | 51.5700 | 68.5300 | 44.6500 | 57.2900 | 40.3800 | 24.1900 | 33.4700 | 19.3400 | 38.6700 | 35.9700 | 28.9700 | 80.5600 | 25.2500 | 59.7400 | 37.6700 | 39.1000 | 33.0500 | 74.8500 | 52.5200 | 31.1300 | 26.3400 | 22.9000 | 56.3000 | 22.9200 | 54.4100 | 27.9000 | 44.3800 | 56.4500 |

4 | 1/6/2006 | 1.0959e+04 | 29.0200 | 68.8900 | 51.7500 | 67.5700 | 44.6500 | 58.4300 | 40.5500 | 24.5200 | 33.7000 | 19.6100 | 38.9600 | 36.5300 | 29.8000 | 82.9600 | 25.2800 | 60.0100 | 37.9400 | 39.4700 | 33.2500 | 75.4700 | 52.9500 | 31.0800 | 26.2600 | 23.1600 | 56.2400 | 23.2100 | 54.5800 | 28.0100 | 44.5600 | 57.5700 |

5 | 1/9/2006 | 1.1012e+04 | 29.3700 | 68.5700 | 53.0400 | 67.0100 | 44.4300 | 59.4900 | 40.3200 | 24.7800 | 33.6100 | 21.1200 | 39.3800 | 36.2300 | 30.1700 | 81.7600 | 25.4400 | 60.3800 | 38.5500 | 39.6600 | 33.8800 | 75.8400 | 53.1100 | 31.5800 | 26.2100 | 23.1600 | 56.6700 | 23.3000 | 55.2000 | 28.1200 | 44.4000 | 57.5400 |

6 | 1/10/2006 | 1.1012e+04 | 28.4400 | 69.1800 | 52.8800 | 67.3300 | 44.5700 | 59.2500 | 40.2000 | 25.0900 | 33.4300 | 20.7900 | 40.3300 | 36.1700 | 30.3300 | 82.1000 | 25.1000 | 60.4900 | 38.6100 | 39.7000 | 33.9100 | 75.3700 | 53.0400 | 31.2700 | 26.3500 | 22.7700 | 56.4500 | 23.1600 | 55.2400 | 28.2400 | 44.5400 | 57.9900 |

7 | 1/11/2006 | 1.1043e+04 | 28.0500 | 69.6000 | 52.5900 | 68.3000 | 44.9800 | 59.2800 | 38.8700 | 25.3300 | 33.6600 | 20.6100 | 41.4400 | 36.1900 | 30.8800 | 82.1900 | 25.1200 | 59.9100 | 38.5800 | 39.7200 | 34.5000 | 75.2200 | 53.3100 | 31.3900 | 26.6300 | 23.0600 | 56.6500 | 23.3400 | 54.4100 | 28.5800 | 45.2300 | 58.3800 |

8 | 1/12/2006 | 1.0962e+04 | 27.6800 | 69.0400 | 52.6000 | 67.9000 | 45.0200 | 60.1300 | 38.0200 | 25.4100 | 33.2500 | 19.7600 | 41.0500 | 35.7700 | 30.5700 | 81.6100 | 24.9600 | 59.6300 | 37.8700 | 39.5000 | 33.9600 | 74.5700 | 53.2300 | 31.4100 | 26.4800 | 22.9000 | 56.0200 | 23.2400 | 53.9000 | 28.6900 | 44.4300 | 57.7700 |

9 | 1/13/2006 | 1.0960e+04 | 27.8100 | 68.8400 | 52.5000 | 67.7000 | 44.9200 | 60.2400 | 37.8600 | 25.4700 | 33.3500 | 19.2000 | 40.4300 | 35.8500 | 31.4300 | 81.2200 | 24.7800 | 59.2600 | 37.8400 | 39.3700 | 33.6500 | 74.3800 | 53.2900 | 31.4000 | 26.5300 | 22.9900 | 56.4900 | 23.2700 | 54.1000 | 28.7500 | 44.1000 | 59.0600 |

10 | 1/17/2006 | 1.0896e+04 | 27.9700 | 67.8400 | 52.0300 | 66.9300 | 44.4700 | 60.8500 | 37.7500 | 25.1500 | 33.2000 | 18.6800 | 40.1100 | 35.5600 | 31.2000 | 81.0500 | 24.5200 | 58.7400 | 37.6400 | 39.1100 | 33.7700 | 73.9900 | 52.8500 | 31.1600 | 26.3400 | 22.6300 | 56.2500 | 23.1300 | 54.4100 | 28.1200 | 43.6600 | 59.6100 |

11 | 1/18/2006 | 1.0855e+04 | 27.8100 | 67.4200 | 51.8400 | 66.5800 | 44.4100 | 60.0400 | 37.5400 | 24.9700 | 33.0800 | 18.9800 | 40.4200 | 35.7100 | 31.2100 | 81.8300 | 21.7200 | 59.6100 | 37.2400 | 38.9100 | 34.1600 | 74.0700 | 52.8900 | 30.9900 | 26.1800 | 22.3600 | 56.5400 | 23.1100 | 54.0800 | 27.8300 | 43.8800 | 58.7800 |

12 | 1/19/2006 | 1.0881e+04 | 28.3300 | 66.9200 | 51.6600 | 66.4200 | 44.0200 | 60.6600 | 37.6900 | 26.0000 | 32.9500 | 19.1000 | 39.8300 | 35.8800 | 31.7700 | 81.1400 | 21.5300 | 59.6000 | 37.0300 | 39.0100 | 34.3600 | 73.8100 | 52.6800 | 31.2600 | 26.3600 | 23.2700 | 56.3900 | 23.1800 | 54.4100 | 28.0700 | 44.4900 | 59.5700 |

13 | 1/20/2006 | 1.0667e+04 | 27.6700 | 65.5500 | 50.4900 | 64.7900 | 41.9500 | 58.9800 | 37.3400 | 25.4900 | 31.7000 | 18.9000 | 38.7600 | 34.5700 | 31.2800 | 79.4500 | 20.9100 | 58.2800 | 36.0700 | 38.2100 | 35.0100 | 72.2100 | 52.1800 | 31.2000 | 25.7700 | 23.0300 | 55.7400 | 23.0100 | 53.4600 | 27.6400 | 43.7100 | 58.6300 |

14 | 1/23/2006 | 1.0689e+04 | 28.0300 | 65.4600 | 50.5300 | 65.3000 | 42.2400 | 59.2300 | 37.3700 | 25.2900 | 31.6300 | 20.6000 | 38.2900 | 34.7800 | 30.8800 | 79.5000 | 20.5200 | 58.6600 | 36.2800 | 38.6000 | 34.8600 | 72.6500 | 52.0900 | 30.8000 | 25.7100 | 23.1900 | 55.5500 | 22.7700 | 52.9400 | 27.6900 | 43.9500 | 59.2800 |

15 | 1/24/2006 | 1.0712e+04 | 28.1600 | 65.3900 | 51.8900 | 65.9200 | 42.2500 | 59.5300 | 37.0900 | 25.7600 | 31.3200 | 21.7300 | 39.0300 | 35.2500 | 30.9100 | 78.9500 | 20.4500 | 56.9000 | 36.1300 | 38.9800 | 35.0000 | 71.2100 | 51.7400 | 30.7600 | 25.6400 | 22.9100 | 55.7700 | 22.9600 | 54.8600 | 27.6000 | 44.4100 | 59.0500 |

16 | 1/25/2006 | 1.0710e+04 | 28.5700 | 64.6700 | 51.9700 | 65.1900 | 42.4500 | 60.2300 | 37.0500 | 25.2100 | 31.1300 | 22.4800 | 38.5700 | 34.7900 | 31.6400 | 79.0100 | 20.3800 | 56.0800 | 36.4800 | 39.2100 | 34.3200 | 70.0600 | 51.4900 | 31.1400 | 25.7600 | 23.1400 | 56.3500 | 23.4700 | 55.4000 | 28.0300 | 44.6500 | 58.3200 |

⋮ |

Setup a portfolio of ten stocks.

symbol = T.Properties.VariableNames(3:12)';

dailyReturn = tick2ret(T{:,3:12});

p = Portfolio('AssetList',symbol,'RiskFreeRate',0.01/252);Estimate the mean and variance of portfolio based on daily returns using estimateAssetMoments.

p = estimateAssetMoments(p,dailyReturn);

Set the total weight of portfolio to 1 where the LowerBudget = 1 and the UpperBudget = 1.

p = setBudget(p,1,1)

p =

Portfolio with properties:

BuyCost: []

SellCost: []

RiskFreeRate: 3.9683e-05

AssetMean: [10×1 double]

AssetCovar: [10×10 double]

TrackingError: []

TrackingPort: []

Turnover: []

BuyTurnover: []

SellTurnover: []

Name: []

NumAssets: 10

AssetList: {'AA' 'AIG' 'AXP' 'BA' 'C' 'CAT' 'DD' 'DIS' 'GE' 'GM'}

InitPort: []

AInequality: []

bInequality: []

AEquality: []

bEquality: []

LowerBound: []

UpperBound: []

LowerBudget: 1

UpperBudget: 1

GroupMatrix: []

LowerGroup: []

UpperGroup: []

GroupA: []

GroupB: []

LowerRatio: []

UpperRatio: []

MinNumAssets: []

MaxNumAssets: []

ConditionalBudgetThreshold: []

ConditionalUpperBudget: []

BoundType: []

Set the maximum allocation for any one security to 50%, and set the minimum for any one security to 5%.

p.LowerBound = repmat(0.05,[10,1]); p.UpperBound = repmat(0.5,[10,1]);

Calculate the portfolio weights for the maximum Sharpe ratio using estimateMaxSharpeRatio.

w1 = estimateMaxSharpeRatio(p)

w1 = 10×1

0.0500

0.0500

0.0500

0.0500

0.0500

0.0500

0.0500

0.4357

0.0500

0.1643

Estimate moments of portfolio returns using estimatePortMoments.

[risk1, ret1] = estimatePortMoments(p,w1)

risk1 = 0.0090

ret1 = 0.0013

Calculate portfolio weights given a target risk.

TargetRisk = 0.01

TargetRisk = 0.0100

Use estimateFrontierByRisk to estimate optimal portfolios with targeted portfolio risks.

w3 = estimateFrontierByRisk(p,TargetRisk)

w3 = 10×1

0.0500

0.0500

0.0500

0.0500

0.0500

0.0500

0.0500

0.3419

0.0500

0.2581

Estimate moments of portfolio returns using estimatePortMoments, where risk3 is estimates for standard deviations of portfolio returns for each portfolio and ret3 is estimates for means of portfolio returns for each portfolio.

[risk3,ret3] = estimatePortMoments(p,w3)

risk3 = 0.0100

ret3 = 0.0013

When any one, or any combination of the constraints from 'Conditional' BoundType, MinNumAssets, and MaxNumAssets are active, the portfolio problem is formulated as mixed integer programming problem and the MINLP solver is used.

Create a Portfolio object for three assets.

AssetMean = [ 0.0101110; 0.0043532; 0.0137058 ];

AssetCovar = [ 0.00324625 0.00022983 0.00420395;

0.00022983 0.00049937 0.00019247;

0.00420395 0.00019247 0.00764097 ];

p = Portfolio('AssetMean', AssetMean, 'AssetCovar', AssetCovar);

p = setDefaultConstraints(p); Use setBounds with semicontinuous constraints to set xi = 0 or 0.02 <= xi <= 0.5 for all i = 1,...NumAssets.

p = setBounds(p, 0.02, 0.7,'BoundType', 'Conditional', 'NumAssets', 3);

When working with a Portfolio object, the setMinMaxNumAssets function enables you to set up the limits on the number of assets invested (as known as cardinality) constraints. This sets the total number of allocated assets satisfying the Bound constraints that are between MinNumAssets and MaxNumAssets. By setting MinNumAssets = MaxNumAssets = 2, only two of the three assets are invested in the portfolio.

p = setMinMaxNumAssets(p, 2, 2);

Use estimateFrontierByRisk to estimate optimal portfolios with targeted portfolio risks.

[pwgt, pbuy, psell] = estimateFrontierByRisk(p,[0.0324241, 0.0694534 ])

pwgt = 3×2

0.0000 0.5000

0.6907 0.0000

0.3093 0.5000

pbuy = 3×2

0.0000 0.5000

0.6907 0.0000

0.3093 0.5000

psell = 3×2

0 0

0 0

0 0

The estimateFrontierByRisk function uses the MINLP solver to solve this problem. Use the setSolverMINLP function to configure the SolverType and options.

p.solverTypeMINLP

ans = 'OuterApproximation'

p.solverOptionsMINLP

ans = struct with fields:

MaxIterations: 1000

AbsoluteGapTolerance: 1.0000e-07

RelativeGapTolerance: 1.0000e-05

NonlinearScalingFactor: 1000

ObjectiveScalingFactor: 1000

Display: 'off'

CutGeneration: 'basic'

MaxIterationsInactiveCut: 30

ActiveCutTolerance: 1.0000e-07

IntMainSolverOptions: [1×1 optim.options.Intlinprog]

NumIterationsEarlyIntegerConvergence: 30

ExtendedFormulation: 0

NumInnerCuts: 10

NumInitialOuterCuts: 10

To obtain efficient portfolios that have targeted portfolio risks, the estimateFrontierByRisk function accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks. Assume you have a universe of four assets where you want to obtain efficient portfolios with target portfolio risks of 12%, 14%, and 16%. This example uses the default'direct' method to estimate the optimal portfolios with targeted portfolio risks. The 'direct' method uses fmincon to solve the optimization problem that maximizes portfolio return, subject to the target risk as the quadratic nonlinear constraint. setSolver specifies the solverType and SolverOptions for fmincon.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

p = Portfolio;

p = setAssetMoments(p, m, C);

p = setDefaultConstraints(p);

p = setSolver(p, 'fmincon', 'Display', 'off', 'Algorithm', 'sqp', ...

'SpecifyObjectiveGradient', true, 'SpecifyConstraintGradient', true, ...

'ConstraintTolerance', 1.0e-8, 'OptimalityTolerance', 1.0e-8, 'StepTolerance', 1.0e-8);

pwgt = estimateFrontierByRisk(p, [0.12, 0.14, 0.16]);

display(pwgt);pwgt = 4×3

0.3984 0.2659 0.1416

0.3064 0.3791 0.4474

0.0882 0.1010 0.1131

0.2071 0.2540 0.2979

To obtain efficient portfolios that have targeted portfolio risks, the estimateFrontierByRisk function accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks. Assume you have a universe of four assets where you want to obtain efficient portfolios with target portfolio risks of 12%, 20%, and 30%.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

rng(11);

p = PortfolioCVaR;

p = simulateNormalScenariosByMoments(p, m, C, 2000);

p = setDefaultConstraints(p);

p = setProbabilityLevel(p, 0.95);

pwgt = estimateFrontierByRisk(p, [0.12, 0.20, 0.30]);

display(pwgt);pwgt = 4×3

0.5363 0.1387 0

0.2655 0.4991 0.3830

0.0570 0.1239 0.1461

0.1412 0.2382 0.4709

The function rng() resets the random number generator to produce the documented results. It is not necessary to reset the random number generator to simulate scenarios.

To obtain efficient portfolios that have targeted portfolio risks, the estimateFrontierByRisk function accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks. Assume you have a universe of four assets where you want to obtain efficient portfolios with target portfolio risks of 12%, 20%, and 25%. This example uses the default 'direct' method to estimate the optimal portfolios with targeted portfolio risks.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

rng(11);

p = PortfolioMAD;

p = simulateNormalScenariosByMoments(p, m, C, 2000);

p = setDefaultConstraints(p);

pwgt = estimateFrontierByRisk(p, [0.12, 0.20, 0.25]);

display(pwgt);pwgt = 4×3

0.1611 0 0

0.4774 0.2137 0.0047

0.1126 0.1384 0.1200

0.2488 0.6480 0.8753

The function rng() resets the random number generator to produce the documented results. It is not necessary to reset the random number generator to simulate scenarios.

To obtain efficient portfolios that have targeted portfolio risks, the estimateFrontierByRisk function accepts one or more target portfolio risks and obtains efficient portfolios with the specified risks. Assume you have a universe of four assets where you want to obtain efficient portfolios with target portfolio risks of 12%, 20%, and 25%. This example uses the default 'direct' method to estimate the optimal portfolios with targeted portfolio risks. The 'direct' method uses fmincon to solve the optimization problem that maximizes portfolio return, subject to the target risk as the quadratic nonlinear constraint. setSolver specifies the solverType and SolverOptions for fmincon.

m = [ 0.05; 0.1; 0.12; 0.18 ];

C = [ 0.0064 0.00408 0.00192 0;

0.00408 0.0289 0.0204 0.0119;

0.00192 0.0204 0.0576 0.0336;

0 0.0119 0.0336 0.1225 ];

rng(11);

p = PortfolioMAD;

p = simulateNormalScenariosByMoments(p, m, C, 2000);

p = setDefaultConstraints(p);

p = setSolver(p, 'fmincon', 'Display', 'off', 'Algorithm', 'sqp', ...

'SpecifyObjectiveGradient', true, 'SpecifyConstraintGradient', true, ...

'ConstraintTolerance', 1.0e-8, 'OptimalityTolerance', 1.0e-8, 'StepTolerance', 1.0e-8);

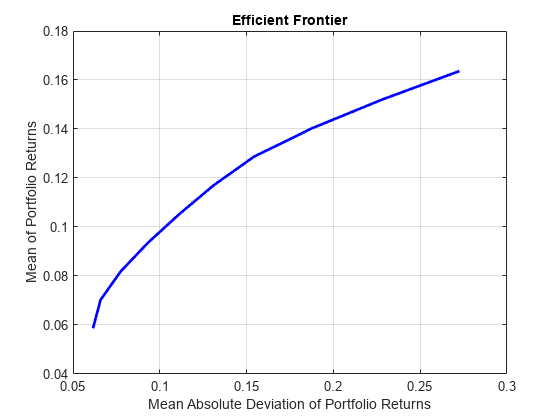

plotFrontier(p);

pwgt = estimateFrontierByRisk(p, [0.12 0.20, 0.25]); display(pwgt);

pwgt = 4×3

0.1613 0.0000 0.0000

0.4777 0.2139 0.0037

0.1118 0.1381 0.1214

0.2492 0.6480 0.8749

Input Arguments

Object for portfolio, specified using Portfolio,

PortfolioCVaR, or PortfolioMAD

object. For more information on creating a portfolio object, see

Note

If no initial portfolio is specified in

obj.InitPort, it is assumed to be

0 so that pbuy =

max(0,pwgt) and psell =

max(0,-pwgt). For more information on setting an

initial portfolio, see setInitPort.

Data Types: object

Target values for portfolio risk, specified as a

NumPorts vector.

Note

If any TargetRisk values are outside the range

of risks for efficient portfolios, the target risk is replaced with

the minimum or maximum efficient portfolio risk, depending on

whether the target risk is below or above the range of efficient

portfolio risks.

Data Types: double

Name-Value Arguments

Specify optional pairs of arguments as

Name1=Value1,...,NameN=ValueN, where Name is

the argument name and Value is the corresponding value.

Name-value arguments must appear after other arguments, but the order of the

pairs does not matter.

Before R2021a, use commas to separate each name and value, and enclose

Name in quotes.

Example: [pwgt,pbuy,psell] =

estimateFrontierByRisk(p,‘method’,‘direct’)

Method to estimate frontier by risk for Portfolio

or PortfolioMAD objects, specified as the

comma-separated pair consisting of 'Method' and a

character vector with one of the following values:

'direct'— Construct one optimization problem to maximize the portfolio return with target risk as the nonlinear constraint, and solve it directly usingfmincon, instead of iteratively exploring the efficient frontier. For an example of using the'direct'option, see Obtain Portfolios with Targeted Portfolio Risks for a Portfolio Object Using the Direct Method and Solver Options and Obtain Portfolios with Targeted Portfolio Risks for a PortfolioMAD Object Using the Direct Method and Solver Options.'iterative'— One-dimensional optimization usingfminbndto find the portfolio return between min and max return on the frontier that minimizes the difference between the actual risk and target risk. Then the portfolio weights are obtained by solving a frontier by return problem. Consequently, the'iterative'method is slower than the'direct'.

Data Types: char

Output Arguments

Optimal portfolios on the efficient frontier with specified target returns

from TargetRisk, returned as a

NumAssets-by-NumPorts matrix.

pwgt is returned for a Portfolio,

PortfolioCVaR, or PortfolioMAD

input object (obj).

Purchases relative to an initial portfolio for optimal portfolios on the

efficient frontier, returned as

NumAssets-by-NumPorts matrix.

Note

If no initial portfolio is specified in

obj.InitPort, that value is assumed to be

0 such that pbuy =

max(0,pwgt) and psell =

max(0,-pwgt).

pbuy is returned for a Portfolio,

PortfolioCVaR, or PortfolioMAD

input object (obj).

Sales relative to an initial portfolio for optimal portfolios on the

efficient frontier, returned as a

NumAssets-by-NumPorts matrix.

Note

If no initial portfolio is specified in

obj.InitPort, that value is assumed to be

0 such that pbuy =

max(0,pwgt) and psell =

max(0,-pwgt).

psell is returned for Portfolio,

PortfolioCVaR, or PortfolioMAD

input object (obj).

Tips

You can also use dot notation to estimate optimal portfolios with targeted portfolio risks.

[pwgt,pbuy,psell] = obj.estimateFrontierByRisk(TargetRisk);

or

[pwgt,pbuy,psell] = obj.estimateFrontierByRisk(TargetRisk,Name,Value);

Version History

Introduced in R2011a

See Also

estimateFrontier | estimateFrontierByReturn | estimateFrontierLimits | setInitPort | rng | setBounds | setMinMaxNumAssets

Topics

- Estimate Efficient Portfolios for Entire Efficient Frontier for Portfolio Object

- Estimate Efficient Frontiers for Portfolio Object

- Estimate Efficient Portfolios for Entire Frontier for PortfolioCVaR Object

- Estimate Efficient Frontiers for PortfolioCVaR Object

- Estimate Efficient Portfolios Along the Entire Frontier for PortfolioMAD Object

- Estimate Efficient Frontiers for PortfolioMAD Object

- Portfolio Optimization Examples Using Financial Toolbox

- Black-Litterman Portfolio Optimization Using Financial Toolbox

- Portfolio Optimization Using Factor Models

- Add Risk Constraint to a Custom Objective Problem

- Portfolio Optimization Theory

MATLAB Command

You clicked a link that corresponds to this MATLAB command:

Run the command by entering it in the MATLAB Command Window. Web browsers do not support MATLAB commands.

Web サイトの選択

Web サイトを選択すると、翻訳されたコンテンツにアクセスし、地域のイベントやサービスを確認できます。現在の位置情報に基づき、次のサイトの選択を推奨します:

また、以下のリストから Web サイトを選択することもできます。

最適なサイトパフォーマンスの取得方法

中国のサイト (中国語または英語) を選択することで、最適なサイトパフォーマンスが得られます。その他の国の MathWorks のサイトは、お客様の地域からのアクセスが最適化されていません。

南北アメリカ

- América Latina (Español)

- Canada (English)

- United States (English)

ヨーロッパ

- Belgium (English)

- Denmark (English)

- Deutschland (Deutsch)

- España (Español)

- Finland (English)

- France (Français)

- Ireland (English)

- Italia (Italiano)

- Luxembourg (English)

- Netherlands (English)

- Norway (English)

- Österreich (Deutsch)

- Portugal (English)

- Sweden (English)

- Switzerland

- United Kingdom (English)