結果 228 件

Files from the November 18, 2010 webinar.

Files used in the webinar - Algorithmic Trading with MATLAB Products for Financial Applications broadcast on November 18, 2010. This webinar can be viewed at

Files from the Automated Trading webinar showing X_Trader and QuickFIX/J integration.

Files used in the webinar - Automated Trading with MATLAB broadcast on August 21, 2012. This webinar can be viewed at www.mathworks.com/videos/automated-trading-with-matlab-81911.htmlSpecific topics

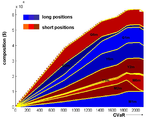

Demos from the 'Commodities Trading with MATLAB' webinar - July 25, 2013.

This submission contains files from the "Commodities Trading with MATLAB" webinar, broadcast on July 25, 2013. The webinar can be viewed at

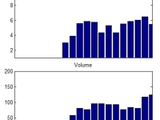

(price/volume chart)

'. Please see TradeMonitorDemo.m for an example.

This package allows to compute the probability of informed trading from bilateral trades.

The probability of informed trading (PIN) denotes that probability that a counterparty in the trading process has superior information on the value of the asset exchanged. This is a key concept in

Files from the webinar can be viewed at http://optinum.co.za/_webinar/BloombergEMSXandMATLAB.mp4

Demo files from the OPTI-NUM solutions webinar - Algorithmic Trading with Bloomberg EMSX and MATLAB.The main demo files

Rotman Trader Toolbox provides functionality for connecting MATLAB(R) to Rotman Interactive Trader

Rotman Trader Toolbox allows you to connect to Rotman Interactive Trader from MATLAB(R). From within MATLAB, you can retrieve information in real-time as well as submit trading orders. You can

How to Build an Event-based Automated Trading System in MATLAB

Files used in the webinar - Automated Trading System Development with MATLAB broadcast on August 20, 2015. This webinar can be viewed at

Realtime trading demo & presentation, presented at NYC Computational Finance Conference 23 May 2013

These are the files used for my presentation "Realtime Trading with MATLAB", at the MATLAB Computational Finance Conference in New York on May 23, 2013, and updated for the MATLAB Computational

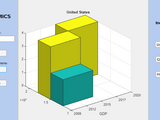

MATLAB code for the generation asset risk analysis case study

A band trading strategy implemented in MATLAB.

This MATLAB function implements a simple band trading strategy. A band consists of two lines that form the upper and lower boundaries of the band. The upper and lower boundaries are used to to enter

Suite of functions for accessing the Binance API via MATLAB. Supports spot and margin trading and all public endpoints.

MATLAB Binance APISuite of functions for accessing the Binance API via MATLAB (R2019b or later). This package supports spot and margin trading and all public endpoints.v0.1.6Disclaimer:This

This BTC-e trade api can be used to automatically trade on btc-e using their api.

These matlab files will allow you to use all methods of the btc-e api. These include:response = GetInfo()response = TransHistory()response = TradeHistory('count',2)response = ActiveOrders()response =

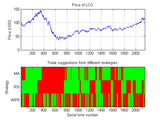

This program shows the profit and lost of using different trading strategies on Singapore stocks.

Directions to run the file.1. Unzip the file "TradingStrat.zip" so that you'll get the folder "TradingStrat".2. Set your working directory as "TradingStrat > CSV" (The CSV folder holds the comma

Uses Moving Averages to Trade the VIX

MATLAB example on how to use Reinforcement Learning for developing a financial trading model

Reinforcement Learning For Financial Trading ?How to use Reinforcement learning for financial trading using Simulated Stock Data using MATLAB.SetupTo run:Open RL_trading_demo.prjOpen workflow.mlxRun

Full generalization of Black-Litterman and related techniques via entropy pooling

Files for webinar titled "Classifying Trading Signals using Machine Learning and Deep Learning"

バージョン 1.1.0.0

MathWorks Quant TeamYou will learn how to classify trading signals into "buy" or "sell" using machine/deep learning

Using the stock index data, we will show how to perform:- Data preprocessing, factor creation, and data partitioning - Rule-based trading (Demo1)- Classifying trading signals using Classification

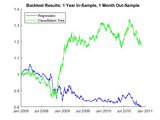

The files are designed for walk-forward analysis of pair trading strategy using Bollinger Band

The files are designed for walk-forward analysis of pair trading strategy using Bollinger Band as entry and exit rules. In this example, you will see 5 pair of stocks tested over the period of 3

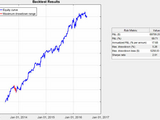

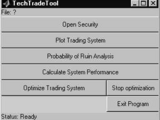

A toolbox for calculating and optimizing technical analysis trading systems.

In the age of computerized trading, financial services companies and independent traders must quickly develop and deploy dynamic technical trading systems. The technical trader's toolbox includes

Demo files from (upcoming) webinar on Machine Learning for Algo Trading

All the sample code and relevant data showed during the webinar Machine Learning for Algo Trading.The video link is here: https://www.mathworks.com/videos/machine-learning-for-algorithmic-trading

A Toolbox that allows the user to backtest trading strategies on the FTSE100.

This toolbox allows the user to backtest trading strategies on the FTSE100. Once strategy has been programmed in the following measures to evaluate the performance of the strategy. -

I wrote these .m files to connect to my MBTrading accounts for automated trading using matlab code.

Allows connection to MBTrading for either simulated trading (delayed quotes and fake money) or real trading (real-time quotes and actual funds). Various files for account connection, quotes and

An intraday trading algorithm to absorb the shock to the stock market when rebalancing a portfolio

M-file scripts and Simulink models from webinar on 28 May 2009

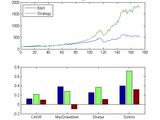

These are the files and some of the data that I used in my recent webinar on Algorithmic Trading. Data has been shortened for size reasons. Included are:MARISANearest Neighbour modelTrailing

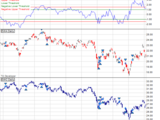

View a stock's buy/sell recommendations based on a synthesis of the indicators SMA, MACD, and RSI

trading tool candlestick chart

The script downloads 10 years of stock data from Yahoo Finance.

Open source/open architecture quantitative portfolio management environment.

Code to Backtest trading strategy

%Author: Moeti Ncube%This is code that can be used to backtest a trading strategy. The example strategy used was partially used in the development of a medium-frequency algorithmic trading strategy

Freely generate data, identify models, and visualize results using over 50 (physics-informed) data-driven approaches.

GUI for viewing various simple technical analysis indicators of a time series

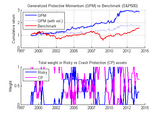

Implementation and example of the Generalized Protective Momentum trading strategy

SEHR-ECHO v1.0: a Spatially Explicit Hydrologic Response model for ecohydrologic applications

バージョン 1.6.0.0

Bettina SchaefliThe model simulates streamflow from precipitation and temperature data.

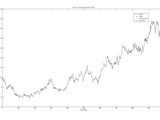

Calculates the annualized historical volatility for a stock over the previous N trading days.

This program calculates the annualized historical volatility for one or more stocks over a user-specified number of N trading days. The program uses daily closing prices in the calculations. If not

A pairs trading strategy implemented in MATLAB.

This demo uses MATLAB and the Technical Analysis (TA) Developer Toolbox (http://www.tadeveloper.com) to develop and backtest a pairs trading strategy. In particular, it is shown how a statistical

This m-file will show you the dynamic pairs trading using the stochastic control approach.

Algo Trading for Ethanol

Algo Trading for few natural gases using VIX to forecast prices

App to get charts from historical data, using Trading Economics API.

Example on how to interact Trading Economics historical data for indicators using the API, and plotting the data into a simple chart.If you are not a client, go to developer.tradingeconomics.com and

(No, we don't trade babies!)

..but build a primitive, stylized automated trading system operated by a fixed-rate timer and handling retrieval, storage and analysis of data; a 'strategy' guides rebalancing the portfolio at each

A MATLAB trading strategy based on a candle stick pattern.

The "Three Red Candles" trading strategy buys at the open price of the next bar when three red candles occur in a row. A red candle is defined by the closing price of a bar being equal to or smaller

Simulation to explore changing all long trade signals to short on a geometric brownian motion path.

Generates GBM curve with specified drift and volatility parameters.Trade entries are modeled through a zero-intelligence model assuming a Poisson arrival process for trades conditioned on a set

Replication of several trading strategies presented on quantifiedstrategies.com

This program replicates the trading strategy results within Oddmund Grotte's blog quantifiedstrategies.com. I replicate the strategies that are based off of the SPY exchange traded fund and aggregate

Different exchange rules modify an nitial distribution of wealth among traders.

Returns dates corresponding to non-trading days for the Johannesburg Stock Exchange in South Africa

This function allows the user to specify a start and end date, and then returns a vector of serial date numbers corresponding to the holidays and non-trading days between the two chosen dates for the

A MATLAB project implementing Garpinger’s trade-off diagram approach for PID controller tuning and performance analysis.

## NameGarpinger's Trade-Off Diagram Toolbox for PID Control Design## DescriptionA MATLAB project implementing Garpinger’s trade-off diagram approach for PID controller tuning and performance

PortfolioEffect MATLAB interface for intraday portfolio analytics with high frequency market data

Official mForex API binding for Matlab.

The goal of mForex.Matlab API is to provide flexible, asynchronous programming model for Matlab (based on mForex API) for building real-time trading systems.

This function computes the number of intradaily market trades that are buy- or sell-initiated.

This routine uses bid and ask quotes sample intradaily at a uniform frequency to classify the implied origin of market trading activity. It computes the implied number of sell-initiated

Calculates values for Directional Movement System like J. Welles Wilder describes in his book 'New Concepts in Technical Trading Systems'

Calculation of the Directional Movement System - This function calculates the values needed to trade the Directional Movement System like J. Welles Wilder describes in his book 'New Concepts in

Wilder Volatility Index for Trading

Retrieves the previous working day for a given date and holiday schedule.

Gives best buy and sell signal to benchmark trading system.

included.Tradeguie signal offers a practical trading benchmark training set for Neural Networks and other learning algorithms or TA.There are no hold signals generated.

A distributed robotic testbed for experimental validation of multi-agent algorithms.

Plots the trade-off between objective functions as PARALLEL plot

The TA-Lib Library is widely used by trading software developers.

The TA-Lib Library is widely used by trading software developers requiring to perform technical analysis of financial market data. If you want to use it within the Matlab environment you will easily

This book was written to aid in research into signal processing algorithms with application to trading.

intended to explain an approach to backtesting and partial optimization of a trading strategy. Backtesting and selection of parameters through testing or optimization (improvement) are critical to the

Obtain structured data for all stock and fund tickers from the BATS website

This function downloads the public CSV file of all ticker symbols traded on the BATS exchange (list changed at least daily). This can be reconciled against a reference date/time, in which case change

Examples showing how to perform TCA Analysis using the MATLAB Trading Toolbox TCA Functions

TCAScriptMATLABWebinar_20161206.mWebinar Presentation showing how to perform Transaction Costs Analysis (TCA) using the MATLAB Trading Toolbox TCA Functions.This script applies to Algorithmic Trading

A function suite for accessing OANDA's REST API with MatLab

required allowing you to take a strategy from backtesting to live trading with minimal effort.