Create Multiplicative ARIMA Models

These examples show how to create various multiplicative seasonal

autoregressive integrated moving average (ARIMA) models by using the arima function.

Seasonal ARIMA Model with No Constant Term

This example shows how to use arima to specify a multiplicative seasonal ARIMA model (for monthly data) with no constant term.

Specify a multiplicative seasonal ARIMA model with no constant term,

where the innovation distribution is Gaussian with constant variance. Here, is the first degree nonseasonal differencing operator and is the first degree seasonal differencing operator with periodicity 12.

Mdl = arima('Constant',0,'ARLags',1,'SARLags',12,'D',1,... 'Seasonality',12,'MALags',1,'SMALags',12)

Mdl =

arima with properties:

Description: "ARIMA(1,1,1) Model Seasonally Integrated with Seasonal AR(12) and MA(12) (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 26

D: 1

Q: 13

Constant: 0

AR: {NaN} at lag [1]

SAR: {NaN} at lag [12]

MA: {NaN} at lag [1]

SMA: {NaN} at lag [12]

Seasonality: 12

Beta: [1×0]

Variance: NaN

The name-value pair argument ARLags specifies the lag corresponding to the nonseasonal AR coefficient, . SARLags specifies the lag corresponding to the seasonal AR coefficient, here at lag 12. The nonseasonal and seasonal MA coefficients are specified similarly. D specifies the degree of nonseasonal integration. Seasonality specifies the periodicity of the time series, for example Seasonality = 12 indicates monthly data. Since Seasonality is greater than 0, the degree of seasonal integration is one.

Whenever you include seasonal AR or MA polynomials (signaled by specifying SAR or SMA) in the model specification, arima incorporates them multiplicatively. arima sets the property P equal to p + D + + s (here, 1 + 1 + 12 + 12 = 26). Similarly, arima sets the property Q equal to q + (here, 1 + 12 = 13).

Display the value of SAR:

Mdl.SAR

ans=1×12 cell array

{[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[0]} {[NaN]}

The SAR cell array returns 12 elements, as specified by SARLags. arima sets the coefficients at interim lags equal to zero to maintain consistency with MATLAB® cell array indexing. Therefore, the only nonzero coefficient corresponds to lag 12.

All of the other properties of Mdl are NaN-valued, indicating that the corresponding model parameters are estimable, or you can specify their value by using dot notation.

Seasonal ARIMA Model with Known Parameter Values

This example shows how to specify a multiplicative seasonal ARIMA model (for quarterly data) with known parameter values. You can use such a fully specified model as an input to simulate or forecast.

Specify the multiplicative seasonal ARIMA model

where the innovation distribution is Gaussian with constant variance 0.15. Here, is the nonseasonal differencing operator and is the first degree seasonal differencing operator with periodicity 4.

Mdl = arima('Constant',0,'AR',0.5,'D',1,'MA',0.3,... 'Seasonality',4,'SAR',-0.7,'SARLags',4,... 'SMA',-0.2,'SMALags',4,'Variance',0.15)

Mdl =

arima with properties:

Description: "ARIMA(1,1,1) Model Seasonally Integrated with Seasonal AR(4) and MA(4) (Gaussian Distribution)"

SeriesName: "Y"

Distribution: Name = "Gaussian"

P: 10

D: 1

Q: 5

Constant: 0

AR: {0.5} at lag [1]

SAR: {-0.7} at lag [4]

MA: {0.3} at lag [1]

SMA: {-0.2} at lag [4]

Seasonality: 4

Beta: [1×0]

Variance: 0.15

The output specifies the nonseasonal and seasonal AR coefficients with opposite signs compared to the lag polynomials. This is consistent with the difference equation form of the model. The output specifies the lags of the seasonal AR and MA coefficients using SARLags and SMALags, respectively. D specifies the degree of nonseasonal integration. Seasonality = 4 specifies quarterly data with one degree of seasonal integration.

All parameter values are specified, that is, no object property is NaN-valued.

Specify Multiplicative ARIMA Model Using Econometric Modeler App

In the Econometric Modeler app, you can specify the lag structure, presence of a constant, and innovation distribution of a SARIMA(p,D,q)×(ps,Ds,qs)s model by following these steps. All specified coefficients are unknown but estimable parameters.

At the command line, open the Econometric Modeler app.

econometricModeler

Alternatively, open the app from the apps gallery (see Econometric Modeler).

In the Time Series pane, select the response time series to which the model will be fit.

On the Econometric Modeler tab, in the Models section, click the arrow to display the models gallery.

In the ARMA/ARIMA Models section of the gallery, click SARIMA. To create SARIMAX models, see Create ARIMA Models That Include Exogenous Covariates.

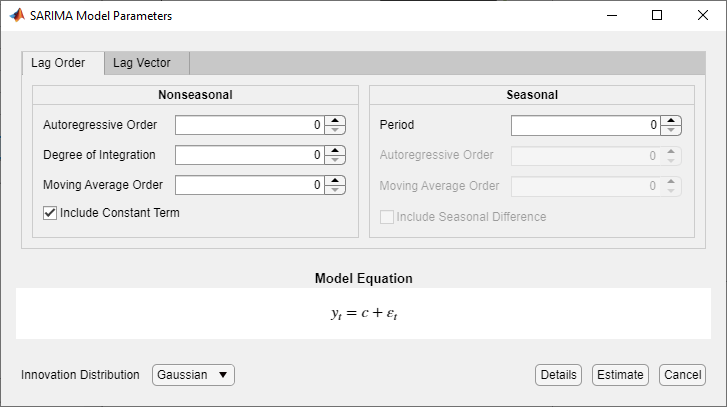

The SARIMA Model Parameters dialog box appears.

Specify the lag structure. Use the Lag Order tab to specify a SARIMA(p,D,q)×(ps,Ds,qs)s model that includes:

All consecutive lags from 1 through their respective orders, in the nonseasonal polynomials

Lags that are all consecutive multiples of the period (s), in the seasonal polynomials

An s-degree seasonal integration polynomial

Use the Lag Vector tab for the flexibility to specify particular lags for all polynomials. For more details, see Specifying Univariate Lag Operator Polynomials Interactively. Regardless of the tab you use, you can verify the model form by inspecting the equation in the Model Equation section.

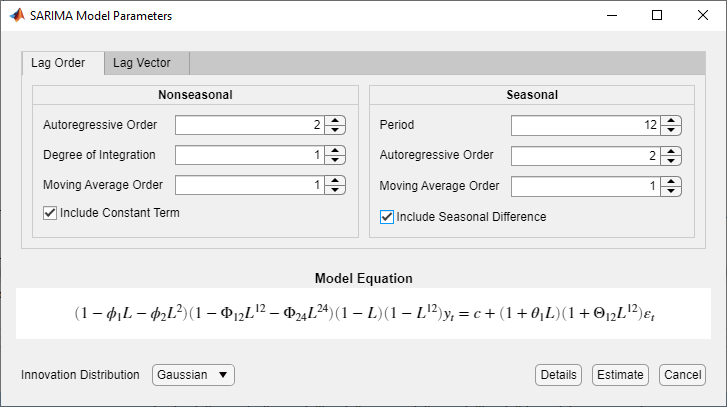

For example, consider this SARIMA(2,1,1)×(2,1,1)12 model.

where εt is a series of IID Gaussian innovations.

The model includes all consecutive AR and MA lags from 1 through their respective orders. Also, the lags of the SAR and SMA polynomials are consecutive multiples of the period from 12 through their respective specified order times 12. Therefore, use the Lag Order tab to specify the model.

In the Nonseasonal section:

Set Degree of Integration to

1.Set Autoregressive Order to

2.Set Moving Average Order to

1.

In the Seasonal section:

Set Period to

12.Set Autoregressive Order to

2. This input specifies the inclusion of SAR lags 12 and 24 (that is, the first and second multiples of the value of Period).Set Moving Average Order to

1. This input specifies the inclusion of SMA lag 12 (that is, the first multiple of the value of Period).Select the Include Seasonal Difference check box.

Verify that the equation in the Model Equation section matches your model.

To exclude a constant from the model and to specify that the innovations are Gaussian, follow the previous steps, and clear the Include Constant Term check box.

To specify t-distributed innovations, follow the previous steps, and click the Innovation Distribution button, then select

t.

For another example, consider this SARIMA(12,1,1)×(2,1,1)12 model.

The model does not include consecutive AR lags, and the lags of the SAR polynomial are not consecutive multiples of the period. Therefore, use the Lag Vector tab to specify this model:

In the SARIMA Model Parameters dialog box, click the Lag Vector tab.

In the Nonseasonal section:

Set Degree of Integration to

1.Set Autoregressive Lags to

1 12.Set Moving Average Lags to

1.

In the Seasonal section:

Set Seasonality to

12. The app includes a 12-degree seasonal integration polynomial.Set Autoregressive Lags to

24. This input specifies the inclusion of SAR lag 24. The input is independent of the value in the Seasonality box.Set Moving Average Lags to

12. This input specifies the inclusion of SMA lag 12. The input is independent of the value in the Seasonality box.

Verify that the equation in the Model Equation section matches your model.

After you specify a model, click Estimate to estimate all unknown parameters in the model.

What Are Multiplicative ARIMA Models?

Many time series collected periodically (e.g., quarterly or monthly) exhibit a seasonal trend, meaning there is a relationship between observations made during the same period in successive years. In addition to this seasonal relationship, there can also be a relationship between observations made during successive periods. The multiplicative ARIMA model is an extension of the ARIMA model that addresses seasonality and potential seasonal unit roots [1].

In lag operator polynomial notation, . For a series with periodicity s, the multiplicative ARIMA(p,D,q)×(ps,Ds,qs)s is given by

| (1) |

Here, the stable, degree p AR operator polynomial , and is a stable, degree ps AR operator of the same form. Similarly, the invertible, degree q MA operator polynomial , and is an invertible, degree qs MA operator of the same form.

When you specify a multiplicative ARIMA model using arima,

Set the nonseasonal and seasonal AR coefficients with the opposite signs from their respective AR operator polynomials. That is, specify the coefficients as they would appear on the right side of Equation 1.

Set the lags associated with the seasonal polynomials in the periodicity of the observed data (e.g., 4, 8,... for quarterly data, or 12, 24,... for monthly data), and not as multiples of the seasonality (e.g., 1, 2,...). This convention does not conform to standard Box and Jenkins notation, but is a more flexible approach for incorporating multiplicative seasonality.

The nonseasonal differencing operator, accounts for nonstationarity in observations made in successive periods. The seasonal differencing operator, , accounts for nonstationarity in observations made in the same period in successive years. Econometrics Toolbox™ supports only the degrees of seasonal integration Ds = 0 or 1. When you specify s ≥ 0, Econometrics Toolbox sets Ds = 1. Ds = 0 otherwise.

References

[1] Box, George E. P., Gwilym M. Jenkins, and Gregory C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

See Also

Apps

Objects

Functions

Topics

- Specifying Univariate Lag Operator Polynomials Interactively

- Analyze Time Series Data Using Econometric Modeler

- Creating Univariate Conditional Mean Models

- Create Multiplicative Seasonal ARIMA Model for Time Series Data

- Modify Properties of Conditional Mean Model Objects

- Specify Conditional Mean Model Innovation Distribution

- Model Seasonal Lag Effects Using Indicator Variables

- Nonseasonal and Seasonal Differencing