Alpha Vantage data downloader

バージョン 0.11 (15.7 MB) 作成者:

Artem Lensky

Currently the toolbox implements functions to download company fundamentals and economic indicators.

alphavantage-matlab

Donwload cashflow reports

% replace the "demo" apikey below with your own key from https://www.alphavantage.co/support/#api-key

keyAV = "demo";

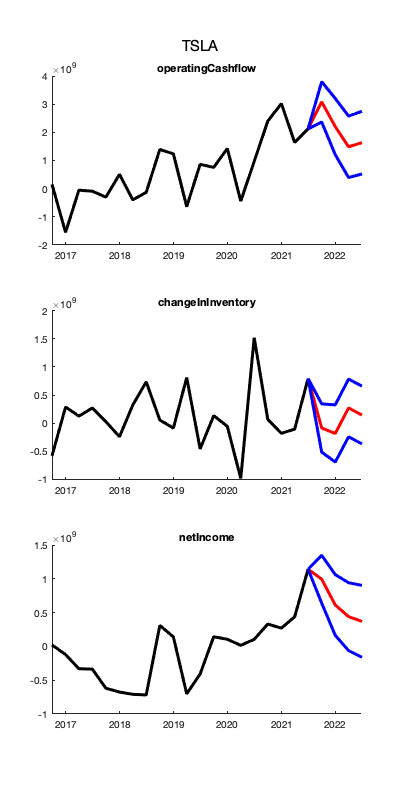

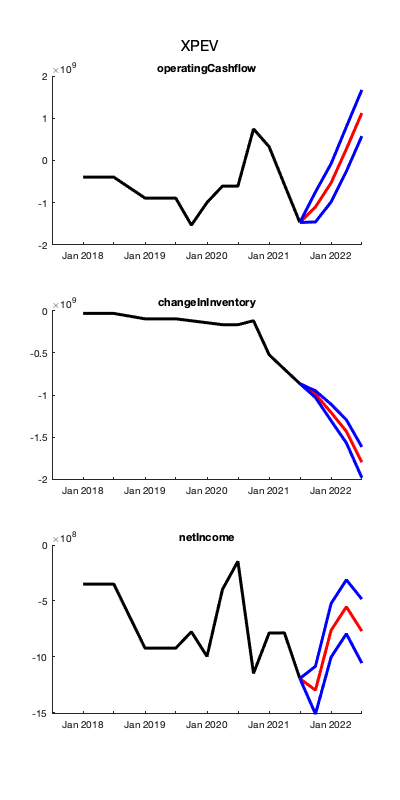

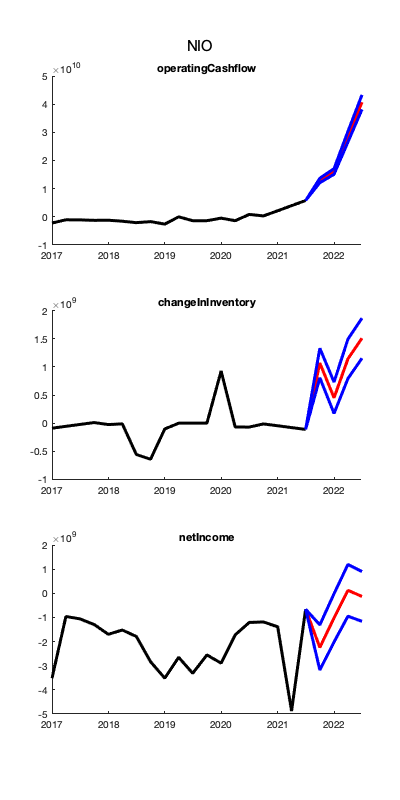

symbols = ["TSLA","XPEV", "NIO"]; % Define symbols of interest

cashflowReports = getFundamentals(symbols, "CASH_FLOW", keyAV); % Donwload reports

% convert company reports to a single table

cashflowTable = extractFields(cashflowReports, ["CASH_FLOW", "quarterlyReport"]);Predict selected cashflow indicators

% Variables to predict

indicatorsOfInterest = [ "operatingCashflow",...

"changeInInventory",...

"netIncome"];

for k = 1:length(symbols)

% Retrieve records for a specific ticker

reportPerCompany = findbyValue(cashflowTable, "Symbol", symbols{k});

% preprocess

options = struct("extrapolate", "linear",...

"removeMissingBy", "column",...

"toCategorical", "",...

"removeColumns", ["reportedCurrency", "Symbol",...

"proceedsFromIssuanceOfCommonStock"]);

reportPerCompanyProcessed = preprocess(reportPerCompany, options);

rawData = reportPerCompanyProcessed(:, indicatorsOfInterest).Variables;

Mdl = varm(length(indicatorsOfInterest), 2);

%Mdl.Trend = NaN; % Estimate trend

[normData, means, stds] = normalize(rawData); % normalise the data

EstMdl = estimate(Mdl, normData);

numOfQs = 4; % Forecast numOfQs quarters

futureDates = dateshift(reportPerCompanyProcessed.fiscalDateEnding(end)...

,'end','quarter', 1:numOfQs); % Dates to predict

futureSim = simulate(EstMdl, numOfQs,'Y0', normData,'NumPaths',2000);

futureSim = (futureSim .* stds) + means; % Denormalise

futureSimMean = mean(futureSim, 3); % Calculate means

futureSimStd = std(futureSim, 0, 3); % Calculate std deviations

% Plot the predictions

figure('color', 'white', 'position', [0, 0, 400, 800]), hold('on');

for l = 1:length(varsOfInterest)

subplot(length(varsOfInterest),1, l), hold on

plot(reportPerCompanyProcessed.fiscalDateEnding, rawData(:,l),'k', 'LineWidth', 3);

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)],'r', 'LineWidth', 3)

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)] + [0; futureSimStd(:, l)],'b', 'LineWidth', 3)

plot([reportPerCompanyProcessed.fiscalDateEnding(end) futureDates],...

[rawData(end,l); futureSimMean(:, l)] - [0; futureSimStd(:, l)],'b', 'LineWidth', 3);

title(varsOfInterest{l});

end

sgtitle(symbols{k});

endDownload Economic Indicators

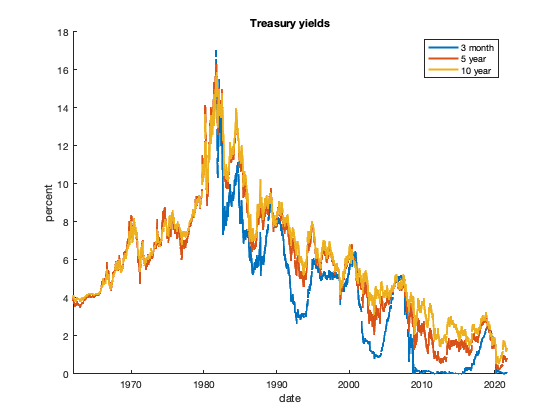

treasury_yield_3month = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "3month"));

treasury_yield_5year = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "5year"));

treasury_yield_10year = getEconomicIndicators("TREASURY_YIELD", keyAV, struct("interval", "daily", "maturity", "10year"));Plot economic indicators

figure('color', 'white'), hold on;

plot(treasury_yield_3month.data.date,treasury_yield_3month.data.value, 'LineWidth', 2);

plot(treasury_yield_5year.data.date, treasury_yield_5year.data.value, 'LineWidth', 2);

plot(treasury_yield_10year.data.date,treasury_yield_10year.data.value, 'LineWidth', 2);

xlabel('date'), ylabel('percent');

title('Treasury yields');

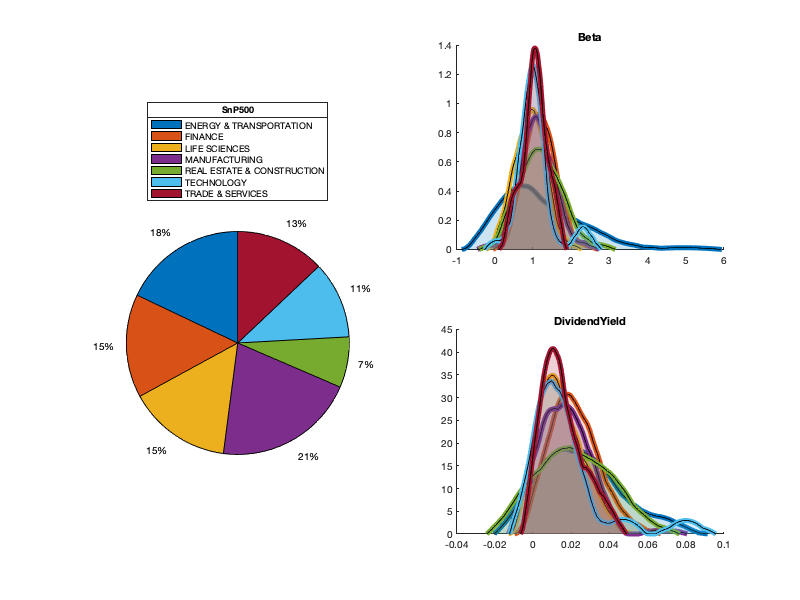

legend({'3 month', '5 year', '10 year'});Donwload SnP500

snp500list = readtable("snp500list.csv");

load reports.mat % comment this line to donwload the data

%reports = getFundamentals(snp500list.Symbol, "ALL", keyAV); % uncommentSummary of SnP500

% preprocess

overviewTable = extractFields(reports, "OVERVIEW");

sectorsLabels = unique(overviewTable.Sector);

removeColumns = ["Symbol","AssetType", "Name", "Description", "Currency",...

"Country","Industry", "Address", "FiscalYearEnd",...

"LatestQuarter", "DividendDate", "ExDividendDate",...

"LastSplitDate"];

options = struct("extrapolate", "linear",...

"removeMissingBy", "row",...

"toCategorical", ["Exchange", "Sector"],...

"removeColumns", removeColumns);

[overviewTableTirm, ind] = preprocess(overviewTable, options);

sectors = unique(overviewTableTirm.Sector);

% plot pie chart

colors = lines(length(sectorsLabels));

figure('color', 'white', 'Position', [1, 1, 800, 600]),

p = subplot(2,2,[1,3]); pie(histcounts(overviewTableTirm.Sector));p.Colormap = lines(7);

lgnd = legend(sectorsLabels, 'Location', 'northoutside'); title(lgnd, 'SnP500');

% plot distributions of selected indicators per sector

colName = {'Beta', 'DividendYield'};

for l = 1:2

subplot(2,2,2*l), hold on,

for k = 1:size(sectors,1)

overviewPerSector{k} = findbyValue(overviewTableTirm, "Sector", sectors(k));

[m, x] = ksdensity(overviewPerSector{k}.(colName{l}), 'Kernel', 'epanechnikov');

plot(x, m,'color', colors(k, :), 'linewidth', 5)

area(x, m, 'FaceColor', colors(k, :), 'FaceAlpha', 0.2);

title(colName{l});

end

end引用

Artem Lensky (2024). Alpha Vantage data downloader (https://github.com/Lenskiy/alphavantage-matlab/releases/tag/v0.11), GitHub. 取得済み .

MATLAB リリースの互換性

作成:

R2021a

すべてのリリースと互換性あり

プラットフォームの互換性

Windows macOS Linuxタグ

Community Treasure Hunt

Find the treasures in MATLAB Central and discover how the community can help you!

Start Hunting!| バージョン | 公開済み | リリース ノート | |

|---|---|---|---|

| 0.11 |

この GitHub アドオンでの問題を表示または報告するには、GitHub リポジトリにアクセスしてください。

この GitHub アドオンでの問題を表示または報告するには、GitHub リポジトリにアクセスしてください。