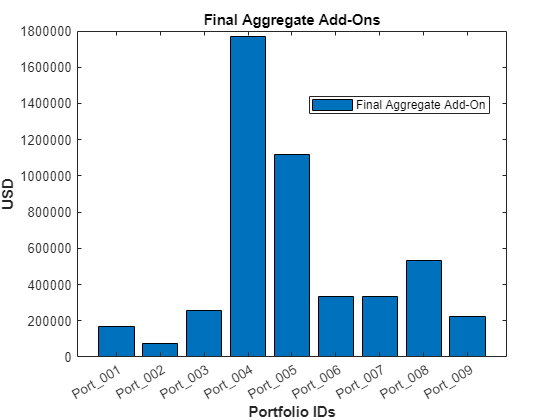

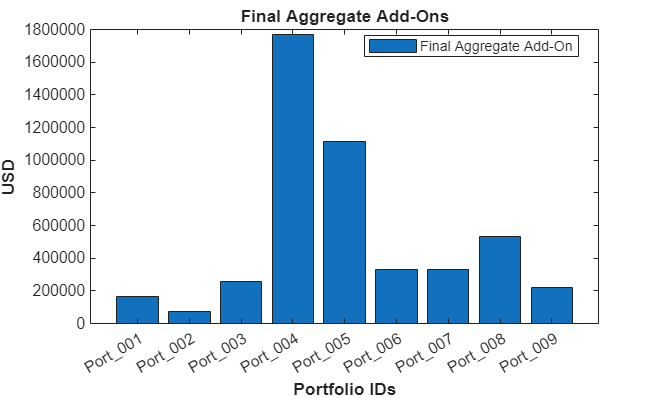

addOnChart

Syntax

Description

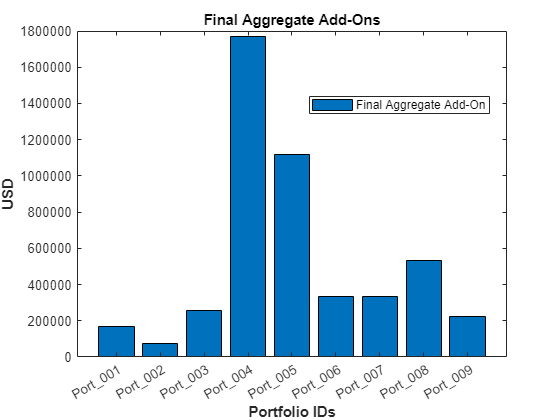

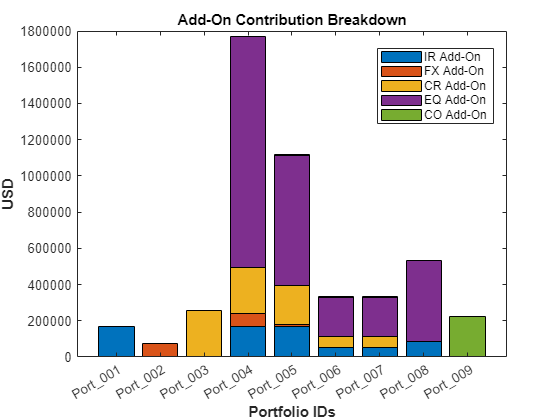

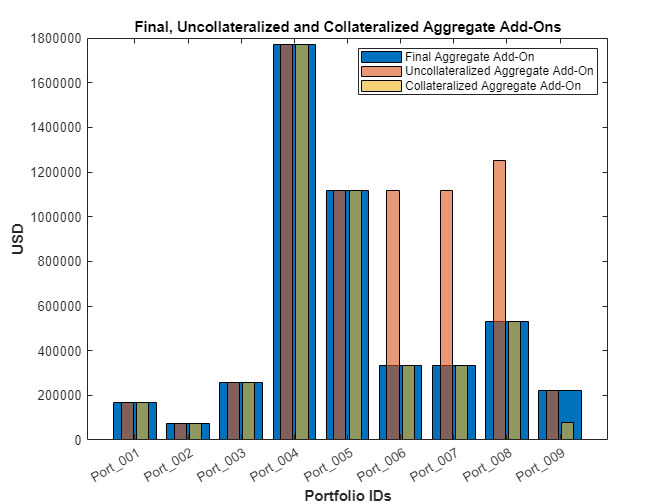

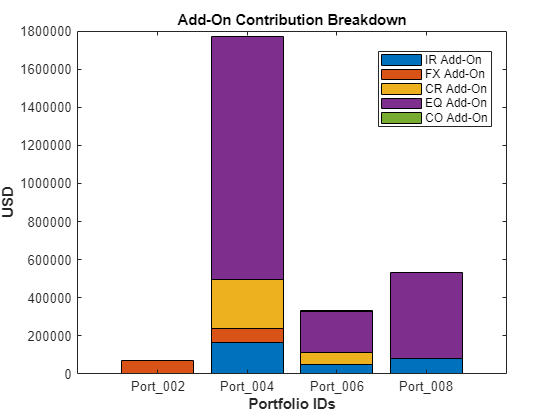

addOnChart( creates a chart of

portfolio add-on values. Each aggregate add-on value can be decomposed into contributions

from the individual asset classes:saccrObj)

Interest rate (IR)

Foreign exchange (FX)

Credit (CR)

Equity (EQ)

Commodity (CO)

The final aggregate add-on values are selected between the uncollateralized and collateralized values to minimize exposure-at-default (EAD). For more information on add-on values, see Add-Ons.

addOnChart(

creates a chart of portfolio add-on values using optional name-value arguments.saccrObj,Name=Value)

Examples

Input Arguments

Name-Value Arguments

Output Arguments

References

[1] Bank for International Settlements. "CRE52 - Standardised Approach to Counterparty Credit Risk." June 2020. Available at https://www.bis.org/basel_framework/chapter/CRE/52.htm.

[2] Bank for International Settlements. "CRE22- Standardised Approach: Credit Risk Migration." November 2020. Available at https://www.bis.org/basel_framework/chapter/CRE/22.htm.

[3] Bank for International Settlements. "Basel Committee on Banking Supervision: The Standardised Approach for Measuring Counterparty Credit Risk Exposures." April 2014. Available at https://www.bis.org/publ/bcbs279.pdf.