Implement Box-Jenkins Model Selection and Estimation Using Econometric Modeler App

This example shows how to use the Box-Jenkins methodology to

select and estimate an ARIMA model by using the Econometric Modeler app. Then, it

shows how to export the estimated model to generate forecasts. The data set, which

is stored in Data_JAustralian.mat, contains the log quarterly

Australian Consumer Price Index (CPI) measured from 1972 and 1991, among other time

series.

Prepare Data for Econometric Modeler

At the command line, load the Data_JAustralian.mat data

set.

load Data_JAustralianImport Data into Econometric Modeler

At the command line, open the Econometric Modeler app.

econometricModeler

Alternatively, open the app from the apps gallery (see Econometric Modeler).

Import DataTimeTable into the app:

On the Econometric Modeler tab, in the Import section, click the Import button

.

.In the Import Data dialog box, in the Import? column, select the check box for the

DataTimeTablevariable.Click Import.

The variables, including PAU, appear in the

Time Series pane, and a time series plot of all the

series appears in the Time Series Plot(EXCH) figure

window.

Create a time series plot of PAU by double-clicking

PAU in the Time Series

pane.

The series appears nonstationary because it has a clear upward trend.

Plot Sample ACF and PACF of Series

Plot the sample autocorrelation function (ACF) and partial autocorrelation function (PACF).

In the Time Series pane, select the

PAUtime series.Click the Plots tab, then click ACF.

Click the Plots tab, then click PACF.

Close all figure windows except for the correlograms. Then, drag the ACF(PAU) figure window above the PACF(PAU) figure window.

The significant, linearly decaying sample ACF indicates a nonstationary process.

Close the ACF(PAU) and PACF(PAU) figure windows.

Difference the Series

Take a first difference of the data. With PAU

selected in the Time Series pane, on the

Econometric Modeler tab, in the

Transforms section, click

Difference.

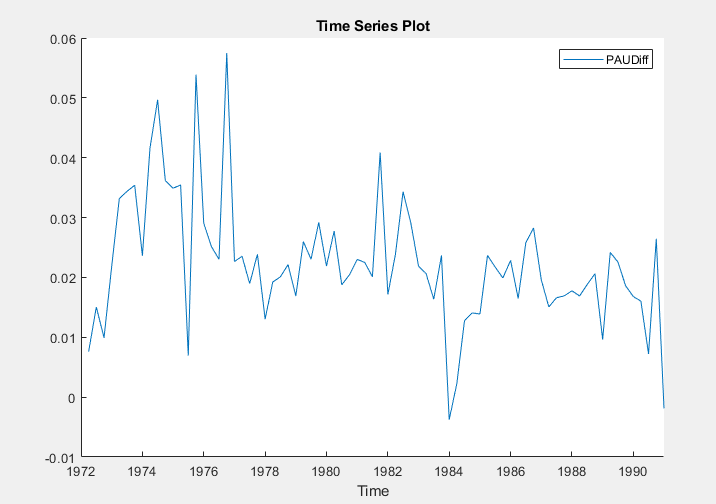

The transformed variable PAUDiff appears in the

Time Series pane, and its time series plot appears in

the Time Series Plot(PAUDiff) figure window.

Differencing removes the linear trend. The differenced series appears more stationary.

Plot Sample ACF and PACF of Differenced Series

Plot the sample ACF and PACF of PAUDiff. With

PAUDiff selected in the Time

Series pane:

Click the Plots tab, then click ACF.

Click the Plots tab, then click PACF.

Close the Time Series Plot(PAUDiff) figure window. Then, drag the ACF(PAUDiff) figure window above the PACF(PAUDiff) figure window.

The sample ACF of the differenced series decays more quickly. The sample PACF cuts off after lag 2. This behavior is consistent with a second-degree autoregressive (AR(2)) model for the differenced series.

Close the ACF(PAUDiff) and PACF(PAUDiff) figure windows.

Specify and Estimate ARIMA Model

Estimate an ARIMA(2,1,0) model for the log quarterly Australian CPI. This model has one degree of nonseasonal differencing and two AR lags.

In the Time Series pane, select the

PAUtime series.On the Econometric Modeler tab, in the Models section, click ARIMA.

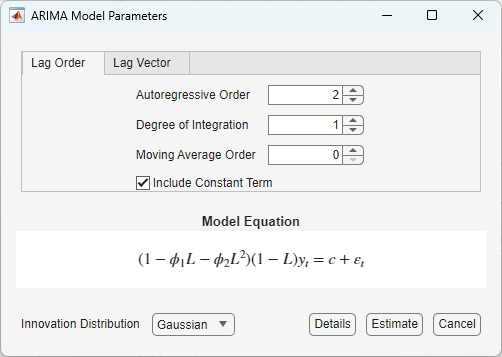

In the ARIMA Model Parameters dialog box, on the Lag Order tab:

Set Degree of Integration to

1.Set Autoregressive Order to

2.

Click Estimate.

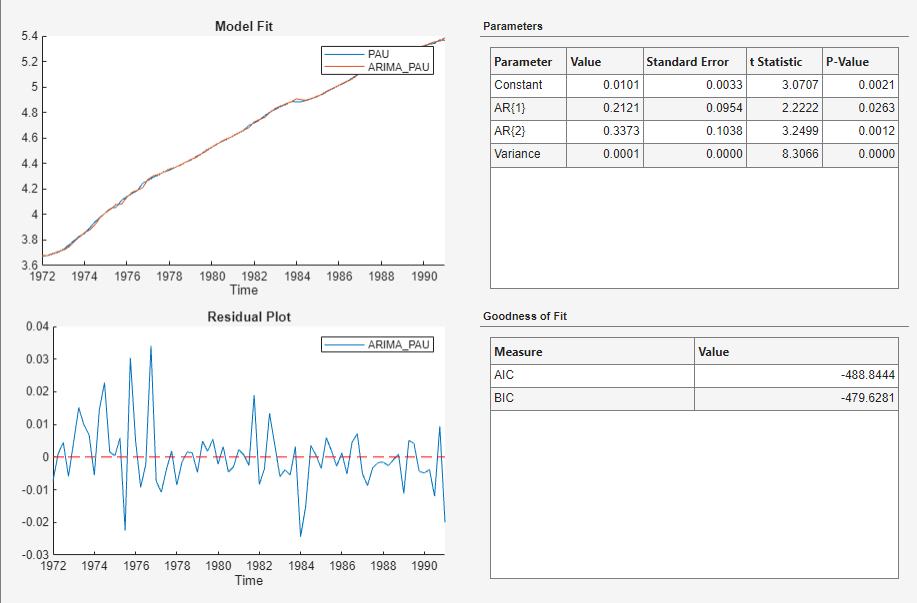

The model variable ARIMA_PAU appears in the

Models pane, its value appears in the

Preview pane, and its estimation summary appears in the

Model Summary(ARIMA_PAU) document.

Both AR coefficients are significant at a 5% significance level.

Check Goodness of Fit

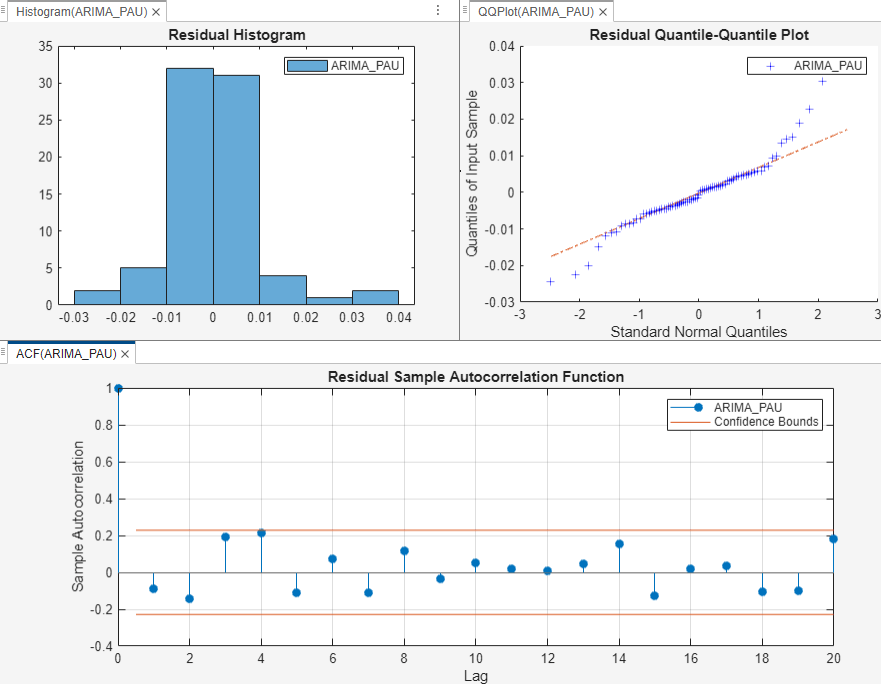

Check that the residuals are normally distributed and uncorrelated by plotting a histogram, quantile-quantile plot, and ACF of the residuals.

Close the Model Summary(ARIMA_PAU) document.

With

ARIMA_PAUselected in the Models pane, on the Econometric Modeler tab, in the Diagnostics section, click Residual Diagnostics > Residual Histogram.Click Residual Diagnostics > Residual Q-Q Plot.

Click Residual Diagnostics > Autocorrelation Function.

In the right pane, drag the Histogram(ARIMA_PAU) and QQPlot(ARIMA_PAU) figure windows so that they occupy the upper two quadrants, and drag the ACF so that it occupies the lower two quadrants.

The residual plots suggest that the residuals are approximately normally distributed and uncorrelated. However, there is some indication of an excess of large residuals. This behavior suggests that a t innovation distribution might be appropriate.

Export Model to Workspace

Export the model to the MATLAB® Workspace.

In the Time Series pane, select the

PAUtime series.On the Econometric Modeler tab, in the Export section, click Export > Export Variables.

In the Export Variables dialog box, select the Select check box for the ARIMA_PAU model.

Click Export. The check box for the PAU time series is already selected.

The variables PAU and ARIMA_PAU appear

in the workspace.

Generate Forecasts at Command Line

Generate forecasts and approximate 95% forecast intervals from the estimated ARIMA(2,1,0) model for the next four years (16 quarters). Use the entire series as a presample for the forecasts.

[PAUF,PAUMSE] = forecast(ARIMA_PAU,16,'Y0',PAU); UB = PAUF + 1.96*sqrt(PAUMSE); LB = PAUF - 1.96*sqrt(PAUMSE); datesF = dates(end) + calquarters(1:16); figure h4 = plot(dates,PAU,'Color',[.75,.75,.75]); hold on h5 = plot(datesF,PAUF,'r','LineWidth',2); h6 = plot(datesF,UB,'k--','LineWidth',1.5); plot(datesF,LB,'k--','LineWidth',1.5); legend([h4,h5,h6],'Log CPI','Forecast',... 'Forecast Interval','Location','Northwest') title('Log Australian CPI Forecast') hold off

References

[1] Box, George E. P., Gwilym M. Jenkins, and Gregory C. Reinsel. Time Series Analysis: Forecasting and Control. 3rd ed. Englewood Cliffs, NJ: Prentice Hall, 1994.

See Also

Apps

Objects

Functions

Topics

- Analyze Time Series Data Using Econometric Modeler

- Perform ARIMA Model Residual Diagnostics Using Econometric Modeler App

- Select ARIMA Model for Time Series Using Box-Jenkins Methodology

- Detect Serial Correlation Using Econometric Modeler App

- Share Results of Econometric Modeler App Session

- Creating ARIMA Models Using Econometric Modeler App