mertonByTimeSeries

Estimate default probability using time-series version of Merton model

Syntax

Description

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Algorithms

Given the time series for equity (E), liability (L),

risk-free interest rate (r), asset drift (μA), and

maturity (T), mertonByTimeSeries sets up the

following system of nonlinear equations and solves for a time series asset values

(A), and a single asset volatility

(σA). At each time period

t, where t =

1...n:

where N is the cumulative normal distribution. To simplify the notation, the time subscript is omitted for d1 and d2. At each time period, d1, and d2 are defined as:

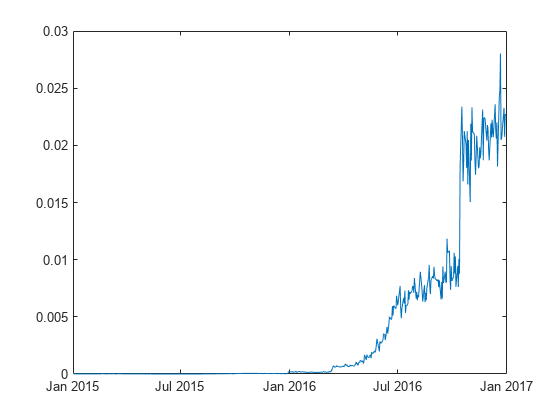

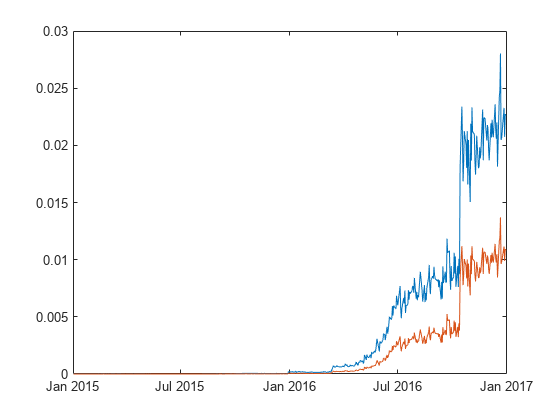

The formulae for the distance-to-default (DD) and default probability (PD) at each time period are:

References

[1] Zielinski, T. Merton's and KMV Models In Credit Risk Management.

[2] Loeffler, G. and Posch, P.N. Credit Risk Modeling Using Excel and VBA. Wiley Finance, 2011.

[3] Kim, I.J., Byun, S.J, Hwang, S.Y. An Iterative Method for Implementing Merton.

[4] Merton, R. C. “On the Pricing of Corporate Debt: The Risk Structure of Interest Rates.” Journal of Finance. Vol. 29. pp. 449 – 470.

Version History

Introduced in R2017a