kpsstest

KPSS test for stationarity

Syntax

Description

h = kpsstest(y)

StatTbl = kpsstest(Tbl)Tbl. To select a different variable in

Tbl to test, use the

DataVariable name-value

argument.

[___] = kpsstest(___,

specifies options using one or more name-value arguments in

addition to any of the input argument combinations in previous syntaxes.

Name=Value)kpsstest returns the output argument combination for the

corresponding input arguments.

Some options control the number of tests to conduct. The following

conditions apply when kpsstest conducts

multiple tests:

For example,

kpsstest(Tbl,DataVariable="GDP",Alpha=0.025,Lags=[0

1]) conducts two tests, at a level of significance

of 0.025, for the presence of a unit root in the variable

GDP of the table Tbl.

The first test includes 0 autocovariance lags in

the Newey-West estimator of the long-run variance and the second

test includes 1 autocovariance lag.

Examples

Input Arguments

Name-Value Arguments

Output Arguments

More About

Tips

To draw valid inferences from a KPSS test, you must determine a suitable value for the

Lagsargument. The following methods can determine a suitable number of lags:Begin with a small number of lags, and then evaluate the sensitivity of the results by adding more lags.

Kwiatkowski et al. [2] suggest that a number of lags on the order of , where T is the effective sample size, is often satisfactory under both the null and the alternative.

For consistency of the Newey-West estimator, the number of lags must approach infinity as the sample size increases.

With a specific testing strategy in mind, determine the value of the

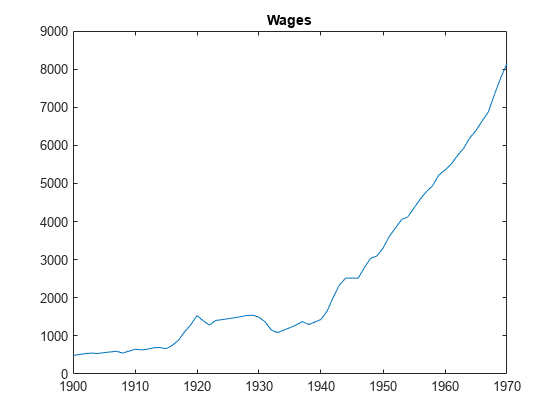

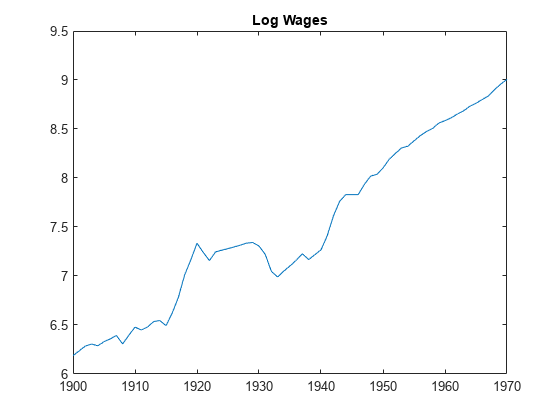

Trendargument by the growth characteristics of the input time series.If the input series grows, include a trend term by setting

Trendtotrue(default). This setting provides a reasonable comparison of a trend stationary null and a unit root process with drift.If a series does not exhibit long-term growth characteristics, exclude a trend term by setting

Trendtofalse.

Algorithms

Test statistics follow nonstandard distributions under the null, even asymptotically. Kwiatkowski et al. [2] use Monte Carlo simulations, for models with and without a trend, to tabulate asymptotic critical values for a standard set of significance levels between 0.01 and 0.1.

kpsstestinterpolates critical values and p-values from these tables.

References

[1] Hamilton, James D. Time Series Analysis. Princeton, NJ: Princeton University Press, 1994.

[2] Kwiatkowski, D., P. C. B. Phillips, P. Schmidt, and Y. Shin. “Testing the Null Hypothesis of Stationarity against the Alternative of a Unit Root.” Journal of Econometrics. Vol. 54, 1992, pp. 159–178.

Version History

Introduced in R2009b