Estimate ARIMAX Model Using Econometric Modeler App

This example shows how to specify and estimate an ARIMAX model

using the Econometric Modeler app. The data set, which is stored in

Data_CreditDefaults.mat, contains annual investment-grade

corporate bond default rates, among other predictors, from 1984 through 2004.

Consider modeling corporate bond default rates as a linear, dynamic function of the

other time series in the data set.

Import Data into Econometric Modeler

At the command line, load the Data_CreditDefaults.mat data

set.

load Data_CreditDefaultsFor more details on the data set, enter Description at the

command line.

At the command line, open the Econometric Modeler app.

econometricModeler

Alternatively, open the app from the apps gallery (see Econometric Modeler).

Import DataTimeTable into the app:

On the Econometric Modeler tab, in the Import section, click the Import button

.

.In the Import Data dialog box, in the Import? column, select the check box for the

DataTimeTablevariable.Click Import.

The variables, including IGD, appear in the

Time Series pane, and a time series plot containing all

the series appears in the Time Series Plot(AGE) figure

window.

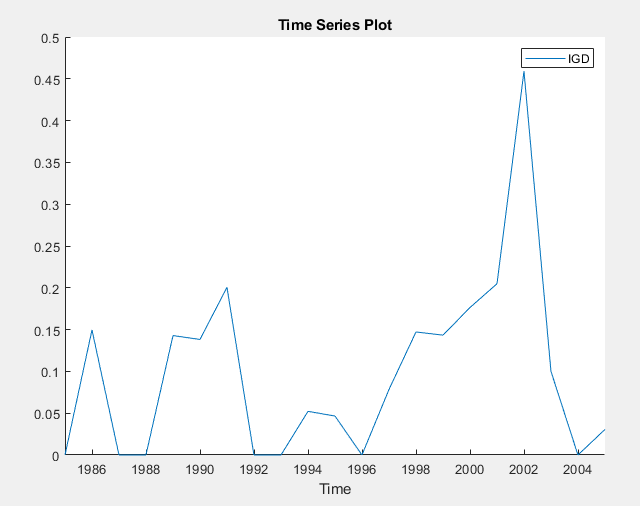

Assess Stationarity of Dependent Variable

In the Time Series pane, double-click

IGD. The value of IGD

appears in the Preview pane, and a time series plot for

IGD appears in the Time Series

Plot(IGD) figure window.

IGD appears to be stationary.

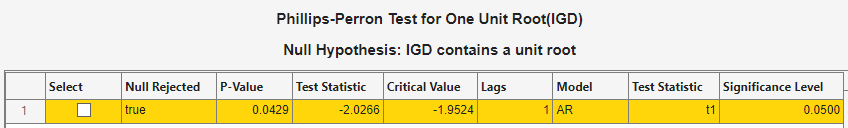

Assess whether IGD has a unit root by conducting a

Phillips-Perron test:

On the Econometric Modeler tab, in the Tests section, click New Test > Phillips-Perron Test.

On the PP tab, in the Parameters section, set Number of Lags to

1.In the Tests section, click Run Test.

The test results in the Results table of the PP(IGD) document.

The test rejects the null hypothesis that IGD

contains a unit root.

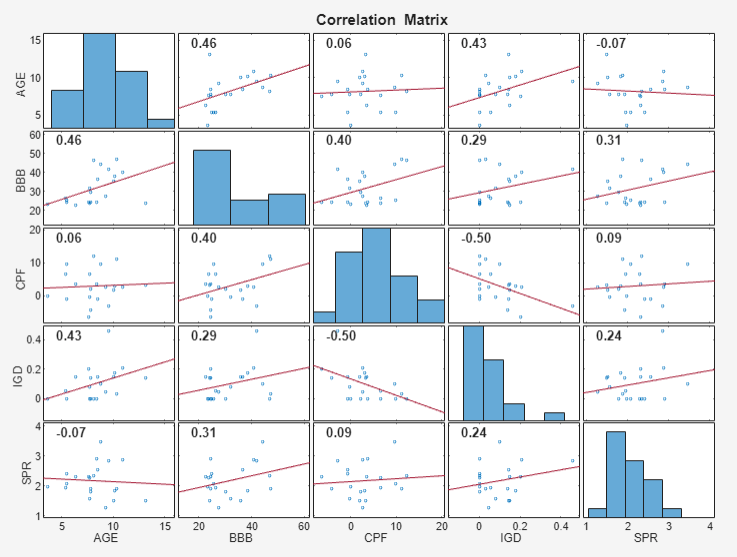

Inspect Correlation and Collinearity Among Variables

Plot the pairwise correlations between variables.

Select all variables in the Time Series pane by clicking

AGE, then press Shift and clickSPR.Click the Plots tab, then click Correlations.

A correlations plot appears in the Correlations(AGE) figure window.

All predictors appear weakly associated with IGD.

You can test whether the correlation coefficients are significant by using

corrplot at the command line.

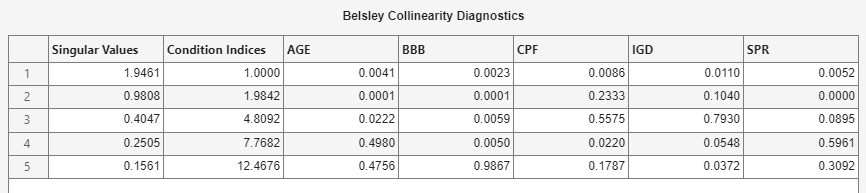

Assess whether any variables are collinear by performing Belsley collinearity diagnostics:

In the Time Series pane, select all variables.

Click the Econometric Modeler tab. Then, in the Tests section, click New Test > Belsley Collinearity Diagnostics.

Tabular results appear in the Collinearity(AGE) document.

None of the condition indices are greater than the condition-index tolerance

(30). Therefore, the variables do not exhibit

multicollinearity.

Specify and Estimate ARIMAX Model

Consider an ARIMAX(0,0,1) model for IGD containing

all predictors. Specify and estimate the model.

In the Time Series pane, click

IGD.Click the Econometric Modeler tab. Then, in the Models section, click the arrow to display the models gallery.

In the models gallery, in the ARMA/ARIMA Models section, click ARIMAX.

In the ARIMAX Model Parameters dialog box, on the Lag Order tab, set Moving Average Order to

1.In the Predictors section, select the Include? check box for each time series.

Click Estimate. The model variable

ARIMAX_IGDappears in the Models pane, its value appears in the Preview pane, and its estimation summary appears in the Model Summary(ARIMAX_IGD) document.

At a 0.10 significance level, all predictors and the MA coefficient are significant.

Close all figure windows and documents.

Check Goodness of Fit

Check that the residuals are normally distributed and uncorrelated by plotting a histogram, quantile-quantile plot, and ACF of the residuals.

In the Models pane, select

ARIMAX_IGD.On the Econometric Modeler tab, in the Diagnostics section, click Residual Diagnostics > Residual Histogram.

Click Residual Diagnostics > Residual Q-Q Plot.

Click Residual Diagnostics > Autocorrelation Function.

In the right pane, drag the Histogram(ARIMAX_IGD) and QQPlot(ARIMAX_IGD) figure windows so that they occupy the upper two quadrants, and drag the ACF so that it occupies the lower two quadrants.

The residual histogram and quantile-quantile plots suggest that the residuals might not be normally distributed. According to the ACF plot, the residuals do not exhibit serial correlation. Standard inferences rely on the normality of the residuals. To remedy nonnormality, you can try transforming the response, then estimating the model using the transformed response.