Compute Capital Risk Charge Using FRTB-SA Framework with Basel Regulations

This example creates a frtbsa object and uses the ISDA® FRTB-SA framework with Basel regulations to support the workflows for calculating capital market risk charge. FRTB-SA (Standardized Approach for Fundamental Review of Trading Book) is a Basel Committee on Banking Supervision framework for calculating market capital risk requirements that is based on a set of standardized risk factors. To calculate the total market risk charge, you need to use only the charge method. However, for the purpose of illustration, this example also demonstrates the frtbsa component methods (sbm, drc, rrao).

Create frtbsa Object

Use bank format to display numeric data using two decimal places.

format bankDefine the ISDA® FRTB-SA CRIF file.

FRTBSACRIF = "FRTBSA_CRIF.csv";Define the DRC reference date.

DrcRefCOBDate = datetime(2023,9,21);

Use frtbsa to create the FRTB-SA object.

myFRTBSA = frtbsa(FRTBSACRIF,DRCValuationDate=DrcRefCOBDate)

myFRTBSA =

frtbsa with properties:

CRIF: [159×18 table]

NumPortfolios: 2.00

PortfolioIDs: [2×1 string]

Portfolios: [2×1 frtbsa.Portfolio]

Regulation: "Basel"

DomesticCurrency: "USD"

DRCValuationDate: 21-Sep-2023

NumDaysYear: 365.00

Examine Output

Display the contents of the ISDA FRTB-SA CRIF file.

myFRTBSA.CRIF

ans=159×18 table

PortfolioID TradeID Variant SensitivityID RiskType Qualifier Bucket Label1 Label2 Amount AmountCurrency AmountUSD Label3 EndDate CreditQuality LongShortInd CoveredBondInd TrancheThickness

___________ ________ ____________ _____________ ____________ __________ ______ _________ ___________ _________ ______________ _________ ______ _______ _____________ ____________ ______________ ________________

"P1" "EQD_a1" <missing> "P1_EQD_a1" "EQ_DELTA" "ISSUER A" "1" <missing> "SPOT" 8250.00 "USD" 8250.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQD_a2" <missing> "P1_EQD_a2" "EQ_DELTA" "ISSUER A" "1" <missing> "REPO" 8333.33 "USD" 8333.33 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQD_b1" <missing> "P1_EQD_b1" "EQ_DELTA" "ISSUER B" "2" <missing> "SPOT" 22000.00 "USD" 22000.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQV_a1" "Variant 1" "P1_EQV_a1" "EQ_VEGA" "ISSUER A" "1" "0.5" <missing> -50.00 "USD" -50.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQV_a2" "Variant 1" "P1_EQV_a2" "EQ_VEGA" "ISSUER A" "1" "1" <missing> 200.00 "USD" 200.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQV_b1" "Variant 1" "P1_EQV_b1" "EQ_VEGA" "ISSUER B" "2" "0.5" <missing> -166.67 "USD" -166.67 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQC_a1" "Variant 1a" "P1_EQC_a1" "EQ_CURV" "ISSUER A" "1" "0.5" <missing> -18910.00 "USD" -18910.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQC_a1" "Variant 1a" "P1_EQC_a1" "EQ_CURV" "ISSUER A" "1" "-0.5" <missing> 6526.25 "USD" 6526.25 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQC_b1" "Variant 1a" "P1_EQC_b1" "EQ_CURV" "ISSUER B" "2" "0.5" <missing> -6288.00 "USD" -6288.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "EQC_b1" "Variant 1a" "P1_EQC_b1" "EQ_CURV" "ISSUER B" "2" "-0.5" <missing> 6120.00 "USD" 6120.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMD_a1" <missing> "P1_CMD_a1" "COMM_DELTA" "COAL" "1" "0" "NEWCASTLE" 2000.00 "USD" 2000.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMD_a2" <missing> "P1_CMD_a2" "COMM_DELTA" "COAL" "1" "0" "LONDON" -500.00 "USD" -500.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMD_b1" <missing> "P1_CMD_b1" "COMM_DELTA" "BRENT" "2" "0" "LE HAVRE" 666.67 "USD" 666.67 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMD_c1" <missing> "P1_CMD_c1" "COMM_DELTA" "WTI" "2" "2" "OKLAHOMA" -875.00 "USD" -875.00 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMV_a1" "Variant 1" "P1_CMV_a1" "COMM_VEGA" "COAL" "1" "0.5" <missing> 333.33 "USD" 333.33 NaN NaT <missing> <missing> <missing> NaN

"P1" "CMV_a2" "Variant 1" "P1_CMV_a2" "COMM_VEGA" "COAL" "1" "1" <missing> -100.00 "USD" -100.00 NaN NaT <missing> <missing> <missing> NaN

⋮

Display the number of portfolios and their IDs.

myFRTBSA.NumPortfolios

ans =

2.00

myFRTBSA.PortfolioIDs

ans = 2×1 string

"P1"

"P2"

Display the properties of the first Portfolio object.

myFRTBSA.Portfolios(1)

ans =

Portfolio with properties:

PortfolioID: "P1"

Trades: [69×1 frtbsa.Trade]

RiskTypes: [69×1 string]

Display risk types of the portfolio.

myFRTBSA.Portfolios(1).RiskTypes

ans = 69×1 string

"EQ_DELTA"

"EQ_DELTA"

"EQ_DELTA"

"EQ_VEGA"

"EQ_VEGA"

"EQ_VEGA"

"EQ_CURV"

"EQ_CURV"

"COMM_DELTA"

"COMM_DELTA"

"COMM_DELTA"

"COMM_DELTA"

"COMM_VEGA"

"COMM_VEGA"

"COMM_VEGA"

"COMM_VEGA"

"COMM_CURV"

"COMM_CURV"

"COMM_CURV"

"GIRR_DELTA"

"GIRR_DELTA"

"GIRR_DELTA"

"GIRR_VEGA"

"GIRR_VEGA"

"GIRR_VEGA"

"GIRR_CURV"

"GIRR_CURV"

"FX_DELTA"

"FX_DELTA"

"FX_VEGA"

⋮

Display some of the trades of the portfolio.

myFRTBSA.Portfolios(1).Trades(1)

ans =

Trade with properties:

TradeID: "EQD_a1"

Variant: <missing>

SensitivityID: "P1_EQD_a1"

RiskType: "EQ_DELTA"

Qualifier: "ISSUER A"

Bucket: "1"

Label1: <missing>

Label2: "SPOT"

Amount: 8250.00

AmountCurrency: "USD"

AmountUSD: 8250.00

Label3: NaN

EndDate: NaT

CreditQuality: <missing>

LongShortInd: <missing>

CoveredBondInd: <missing>

TrancheThickness: NaN

myFRTBSA.Portfolios(1).Trades(30)

ans =

Trade with properties:

TradeID: "FXV_b1"

Variant: "Variant 1"

SensitivityID: "P1_FXV_b1"

RiskType: "FX_VEGA"

Qualifier: "EURCLP"

Bucket: <missing>

Label1: "0.5"

Label2: <missing>

Amount: 175.00

AmountCurrency: "USD"

AmountUSD: 175.00

Label3: NaN

EndDate: NaT

CreditQuality: <missing>

LongShortInd: <missing>

CoveredBondInd: <missing>

TrancheThickness: NaN

myFRTBSA.Portfolios(1).Trades(60)

ans =

Trade with properties:

TradeID: "RRAO_a2"

Variant: <missing>

SensitivityID: "P1_RRAO_a2"

RiskType: "RRAO_01_PERCENT"

Qualifier: <missing>

Bucket: <missing>

Label1: <missing>

Label2: <missing>

Amount: 300000.00

AmountCurrency: "USD"

AmountUSD: 300000.00

Label3: NaN

EndDate: NaT

CreditQuality: <missing>

LongShortInd: <missing>

CoveredBondInd: <missing>

TrancheThickness: NaN

Compute Market Risk Capital Charge

The charge is the sum of the capital charges for all risk factor categories, plus any applicable add-ons. Use charge to compute the capital market risk charge for all portfolios in the frtbsa object.

ChargeResults = charge(myFRTBSA)

ChargeResults =

chargeResults with properties:

NumPortfolios: 2.00

PortfolioIDs: [2×1 string]

Regulation: "Basel"

DomesticCurrency: "USD"

Charges: [2×1 double]

ComponentResults: [2×1 frtbsa.chargePortfolioResults]

ResultsTable: [2×5 table]

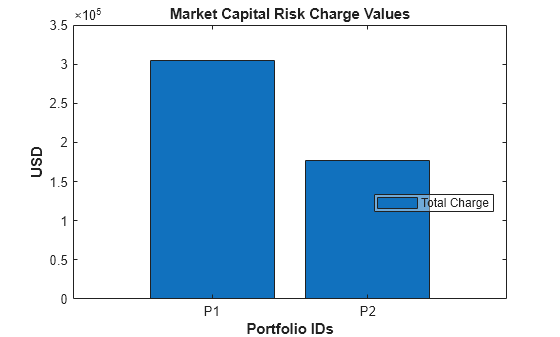

The Charges output contains the capital risk charge of the portfolios.

ChargeResults.Charges

ans = 2×1

304838.07

176339.24

The ResultsTable output contains the high-level risk charge calculations of the portfolios and includes the total portfolio charge, RRAO charge, DRC charge, and SBM charge.

ChargeResults.ResultsTable

ans=2×5 table

PortfolioID Total RRAO DRC SBM

___________ _________ _______ _________ _________

"P1" 304838.07 3310.00 177008.51 124519.56

"P2" 176339.24 2800.00 51024.29 122514.96

The ComponentResults output contains detailed capital risk charge information for a given portfolio.

Examine the market risk capital charge for the second portfolio.

ChargeResults.ComponentResults(2)

ans =

chargePortfolioResults with properties:

PortfolioID: "P2"

Charge: 176339.24

SBM: [1×1 frtbsa.sbmPortfolioResults]

DRC: [1×1 frtbsa.drcPortfolioResults]

RRAO: [1×1 frtbsa.rraoPortfolioResults]

Examine the SBM component of this portfolio.

ChargeResults.ComponentResults(2).SBM

ans =

sbmPortfolioResults with properties:

PortfolioID: "P2"

Charge: 122514.96

ChargeByCorrelation: [1×1 struct]

ChargeByRiskClass: [21×5 table]

IntrabucketCharges: [1×1 struct]

Display charges by risk class.

ChargeResults.ComponentResults(2).SBM.ChargeByRiskClass

ans=21×5 table

RiskClass RiskMeasure LowCorrelation MediumCorrelation HighCorrelation

_________ ___________ ______________ _________________ _______________

"GIRR" "Delta" 300.52 296.23 298.38

"GIRR" "Vega" 316.67 316.67 316.67

"GIRR" "Curvature" 9323.83 9323.83 9323.83

"CSR_NS" "Delta" 62.50 62.47 62.48

"CSR_NS" "Vega" 46.67 47.79 47.24

"CSR_NS" "Curvature" 393.90 393.90 393.90

"CSR_SC" "Delta" 590.07 575.70 582.93

"CSR_SC" "Vega" 198.82 195.75 197.29

"CSR_SC" "Curvature" 39636.44 39634.87 39635.66

"CSR_SNC" "Delta" 456.21 455.99 456.10

"CSR_SNC" "Vega" 506.86 489.20 498.11

"CSR_SNC" "Curvature" 19206.41 19206.41 19206.41

"FX" "Delta" 8.84 8.84 8.84

"FX" "Vega" 150.00 150.00 150.00

"FX" "Curvature" 21373.78 21373.78 21373.78

"EQ" "Delta" 14740.74 14432.78 14587.58

⋮

Examine the DRC component of this portfolio.

ChargeResults.ComponentResults(2).DRC

ans =

drcPortfolioResults with properties:

PortfolioID: "P2"

Charge: 51024.29

ChargeByCreditClass: [2×2 table]

IntrabucketCharges: [1×1 struct]

Display charges by credit class.

ChargeResults.ComponentResults(2).DRC.ChargeByCreditClass

ans=2×2 table

CreditClass Charge

___________ ________

"NS" 20750.00

"SNC" 30274.29

Examine the RRAO component of this portfolio.

ChargeResults.ComponentResults(2).RRAO

ans =

rraoPortfolioResults with properties:

PortfolioID: "P2"

Charge: 2800.00

ChargeBySensitivityID: [2×5 table]

ChargeByInstrumentType: [2×2 table]

Display charges by instrument type.

ChargeResults.ComponentResults(2).RRAO.ChargeByInstrumentType

ans=2×2 table

InstrumentType Charge

______________ _______

"Exotic" 2500.00

"ORR" 300.00

Use the chargeChart function to plot the total capital market risk charge for each portfolio.

chargeChart(myFRTBSA,Style = "final")

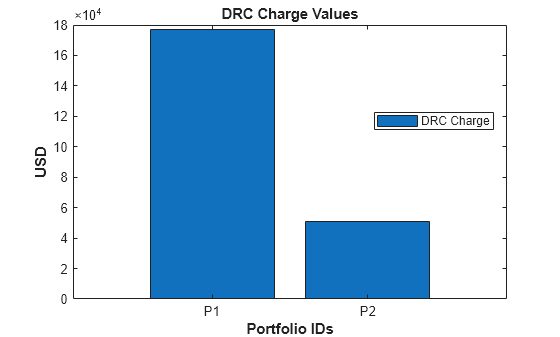

Compute DRC Charge

The default risk capital (DRC) charge captures the risk of default of issuers of debt and equity instruments in the trading book. Use drc to compute the DRC charge for each portfolio using the previously created frtbsa object.

DRCResults = drc(myFRTBSA)

DRCResults =

drcResults with properties:

NumPortfolios: 2.00

PortfolioIDs: [2×1 string]

Regulation: "Basel"

DomesticCurrency: "USD"

Charges: [2×1 double]

ComponentResults: [2×1 frtbsa.drcPortfolioResults]

ResultsTable: [2×4 table]

The Charges output contains the DRC risk charge of the portfolios.

DRCResults.Charges

ans = 2×1

177008.51

51024.29

The ResultsTable output contains the high-level risk DRC charge calculations of the portfolios.

DRCResults.ResultsTable

ans=2×4 table

PortfolioIDs Total NS SNC

____________ _________ ________ _________

"P1" 177008.51 20750.00 156258.51

"P2" 51024.29 20750.00 30274.29

The ComponentResults output contains the detailed DRC risk charge information for a given portfolio.

Examine the DRC risk charge for the first portfolio.

DRCResults.ComponentResults(1)

ans =

drcPortfolioResults with properties:

PortfolioID: "P1"

Charge: 177008.51

ChargeByCreditClass: [2×2 table]

IntrabucketCharges: [1×1 struct]

Display charges by credit class. Portfolio P1 has non-securitization and securitization non-correlation trading portfolio (non-CTP) trades.

DRCResults.ComponentResults(1).ChargeByCreditClass

ans=2×2 table

CreditClass Charge

___________ _________

"NS" 20750.00

"SNC" 156258.51

Display the intrabucket charges for the non-securitization trades.

DRCResults.ComponentResults(1).IntrabucketCharges.NS

ans=2×4 table

Bucket NetLongJtd NetShortJdt Charge

____________ __________ ___________ ________

"CORPORATES" 12750.00 0.00 12750.00

"SOVEREIGNS" 8000.00 0.00 8000.00

Display the intrabucket charges for the securitization non-CTP trades.

DRCResults.ComponentResults(1).IntrabucketCharges.SNC

ans=1×9 table

Bucket NonSeniorLongJtd NonSeniorShortJtd SeniorLongJtd SeniorShortJtd NetLongJtd NetShortJtd HBR Charge

____________ ________________ _________________ _____________ ______________ __________ ___________ ____ _________

"CORPORATES" 0.00 0.00 746666.67 -300000.00 746666.67 300000.00 0.71 156258.51

Use the drcChart function to plot the DRC charges for each portfolio.

drcChart(myFRTBSA,Style = "final")

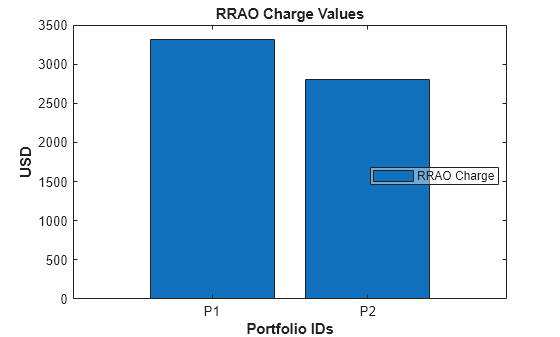

Compute RRAO Capital Charge

The residual risk add-on (RRAO) charge covers risks that are not fully captured by the other components of the FRTB capital charges, particularly those arising from positions with exotic or nonlinear payoffs, as well as other risks that are deemed to be residual in nature. Use rrao to compute the RRAO charge results for each portfolio using the previously created frtbsa object.

RRAOResults = rrao(myFRTBSA)

RRAOResults =

rraoResults with properties:

NumPortfolios: 2.00

PortfolioIDs: [2×1 string]

Regulation: "Basel"

DomesticCurrency: "USD"

Charges: [2×1 double]

ComponentResults: [2×1 frtbsa.rraoPortfolioResults]

ResultsTable: [2×4 table]

The Charges output contains the RRAO risk charge of the portfolio.

RRAOResults.Charges

ans = 2×1

3310.00

2800.00

The ResultsTable output contains the high-level risk RRAO charge calculations of the portfolios.

RRAOResults.ResultsTable

ans=2×4 table

PortfolioIDs Total Exotic ORR

____________ _______ _______ ______

"P1" 3310.00 3000.00 310.00

"P2" 2800.00 2500.00 300.00

The ComponentResults output contains detailed RRAO risk charge information for a given portfolio.

Examine the RRAO risk charge for the first portfolio.

RRAOResults.ComponentResults(1)

ans =

rraoPortfolioResults with properties:

PortfolioID: "P1"

Charge: 3310.00

ChargeBySensitivityID: [4×5 table]

ChargeByInstrumentType: [2×2 table]

Display charges by instrument type. Portfolio P1 has both exotic underlying instruments and other residual risk instruments.

RRAOResults.ComponentResults(1).ChargeByInstrumentType

ans=2×2 table

InstrumentType Charge

______________ _______

"Exotic" 3000.00

"ORR" 310.00

Use the rraoChart function to plot the RRAO capital charges for each portfolio.

rraoChart(myFRTBSA,Style = "final")

Compute SBM Risk Capital Charge

Under the sensitivity-based market (SBM), banks calculate capital charges based on the sensitivities of their trading book positions to various risk factors. Use sbm to compute the SBM charge results for each portfolio using the previously created frtbsa object.

SBMResults = sbm(myFRTBSA)

SBMResults =

sbmResults with properties:

NumPortfolios: 2.00

PortfolioIDs: [2×1 string]

Regulation: "Basel"

DomesticCurrency: "USD"

Charges: [2×1 double]

ComponentResults: [2×1 frtbsa.sbmPortfolioResults]

ResultsTable: [2×10 table]

The Charges output contains the SBM risk charge of the portfolios.

SBMResults.Charges

ans = 2×1

124519.56

122514.96

The ResultsTable output contains the high-level risk SBM charge calculations of the portfolio.

SBMResults.ResultsTable

ans=2×10 table

PortfolioID Correlation Total GIRR CSR_NS CSR_SC CSR_SNC FX EQ COMM

___________ ___________ _________ ________ ______ ________ ________ ________ ________ _______

"P1" "Low" 124519.56 10183.45 815.24 40425.33 20169.47 21532.62 23991.46 7401.98

"P2" "Low" 122514.96 9941.02 503.07 40425.33 20169.47 21532.62 23954.45 5988.99

The ComponentResults output contains detailed SBM risk charge information for a given portfolio.

Examine the SBM risk charge for the first portfolio.

SBMResults.ComponentResults(1)

ans =

sbmPortfolioResults with properties:

PortfolioID: "P1"

Charge: 124519.56

ChargeByCorrelation: [1×1 struct]

ChargeByRiskClass: [21×5 table]

IntrabucketCharges: [1×1 struct]

Display the charges by risk class.

SBMResults.ComponentResults(1).ChargeByRiskClass

ans=21×5 table

RiskClass RiskMeasure LowCorrelation MediumCorrelation HighCorrelation

_________ ___________ ______________ _________________ _______________

"GIRR" "Delta" 342.95 334.39 338.69

"GIRR" "Vega" 516.67 514.22 515.45

"GIRR" "Curvature" 9323.83 9323.83 9323.83

"CSR_NS" "Delta" 265.17 262.20 263.68

"CSR_NS" "Vega" 130.96 129.28 130.12

"CSR_NS" "Curvature" 419.11 418.46 418.79

"CSR_SC" "Delta" 590.07 575.70 582.93

"CSR_SC" "Vega" 198.82 195.75 197.29

"CSR_SC" "Curvature" 39636.44 39634.87 39635.66

"CSR_SNC" "Delta" 456.21 455.99 456.10

"CSR_SNC" "Vega" 506.86 489.20 498.11

"CSR_SNC" "Curvature" 19206.41 19206.41 19206.41

"FX" "Delta" 8.84 8.84 8.84

"FX" "Vega" 150.00 150.00 150.00

"FX" "Curvature" 21373.78 21373.78 21373.78

"EQ" "Delta" 14762.60 14451.94 14608.10

⋮

Display the low correlation scenario charges.

SBMResults.ComponentResults(1).ChargeByCorrelation.Low

ans=8×4 table

Delta Vega Curvature Charge

________ _______ _________ _________

GIRR 342.95 516.67 9323.83 10183.45

CSR_NS 265.17 130.96 419.11 815.24

CSR_SC 590.07 198.82 39636.44 40425.33

CSR_SNC 456.21 506.86 19206.41 20169.47

FX 8.84 150.00 21373.78 21532.62

EQ 14762.60 157.31 9071.55 23991.46

COMM 437.51 234.97 6729.51 7401.98

Total 16863.33 1895.59 105760.63 124519.56

Display the intrabucket charges for this portfolio for the equity class and the delta risk sensitivity.

SBMResults.ComponentResults(1).IntrabucketCharges.EQ.Delta

ans=2×5 table

Bucket Sb LowCorrelation MediumCorrelation HighCorrelation

______ ________ ______________ _________________ _______________

1.00 4583.33 4583.24 4583.29 4583.33

2.00 13200.00 13200.00 13200.00 13200.00

Display the intrabucket charges for this portfolio for the GIRR class and the vega risk sensitivity.

SBMResults.ComponentResults(1).IntrabucketCharges.GIRR.Vega

ans=1×5 table

Bucket Sb LowCorrelation MediumCorrelation HighCorrelation

______ ______ ______________ _________________ _______________

"USD" 516.67 514.22 515.45 516.67

Use the sbmChart function to plot the SBM charge for each portfolio.

sbmChart(myFRTBSA,Style = "final")

See Also

frtbsa | charge | sbm | drc | rrao | saccr